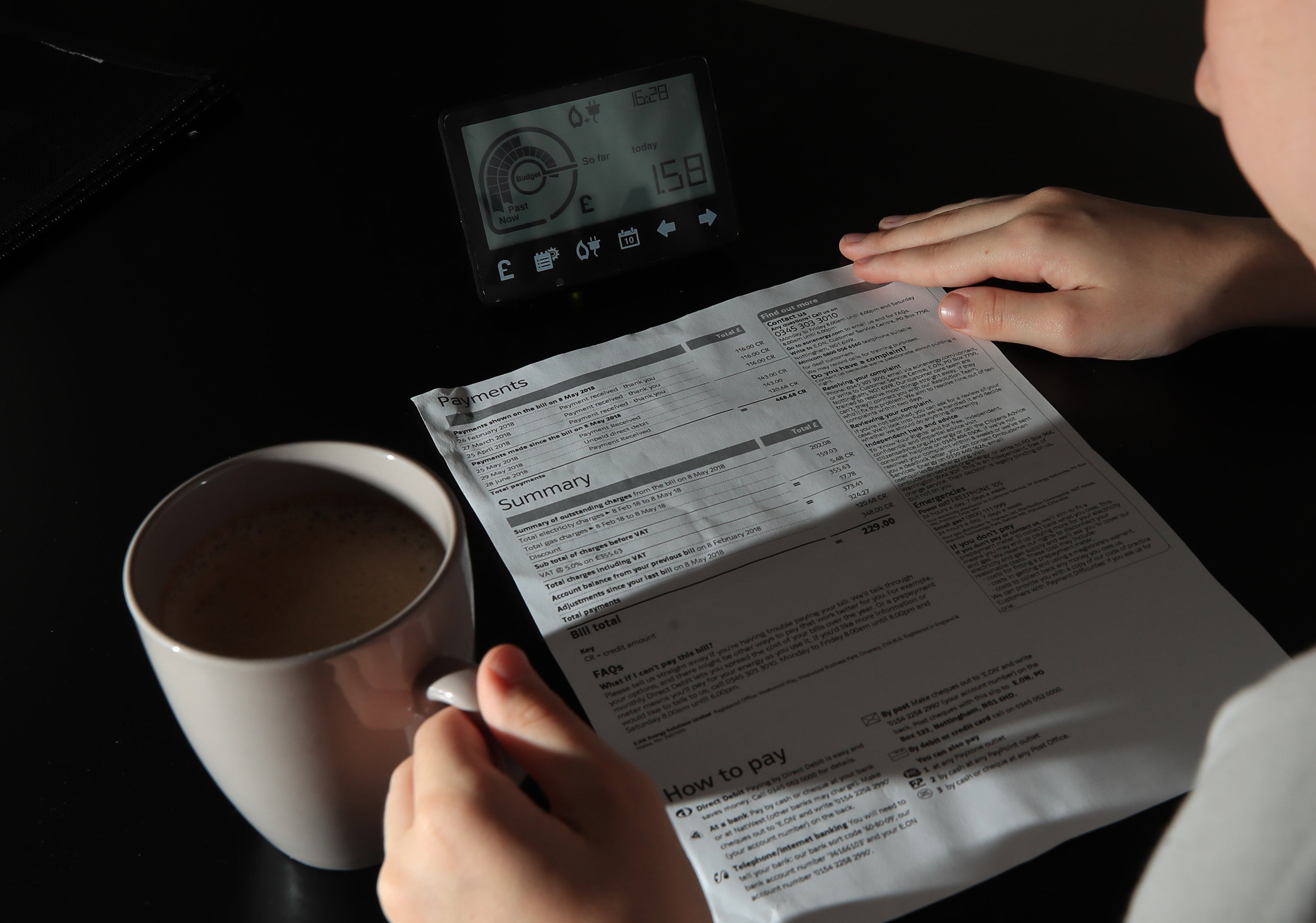

New data has revealed that renters in the UK are facing a disproportionate increase in living costs compared to homeowners, highlighting the deepening inequalities exacerbated by the ongoing housing crisis.

According to the Office for National Statistics (ONS), inflation for renters surged to 3.6 per cent in the year leading up to March, surpassing all other groups. This figure significantly exceeds the overall inflation rate of 2.6 per cent during the same period, demonstrating the escalating burden of rent on the UK’s 5.5 million private tenants.

In stark contrast, homeowners experienced a more moderate increase in costs, with inflation affecting them at a rate of 1.8 per cent.

These figures underscore the challenge facing the government, as it grapples with an acute housing shortage that has driven up rents and property prices in recent years. While Labour has pledged to construct 1.5 million homes by 2030, the Office for Budget Responsibility has forecast a shortfall of approximately 200,000 homes.

Think tank the Resolution Foundation said housing continues to be a “major headwind” in the cost-of-living crisis.

Senior economist Simon Pittaway told the PA news agency: “Inflation is at the forefront of everyone’s minds but some groups have been hit harder by recent price rises than others.

“As policy makers grapple with ongoing cost-of-living concerns, boosting support for low-income families who rent and increasing the availability to homes to buy should be priorities.”

By comparison, people who have mortgages saw inflation ease to 2.8 per cent, well below 5.6 per cent from the year before, after the Bank of England cut interest rates several times in 2024 and early 2025.

The base interest rate helps dictate how expensive it is to take out a mortgage or a loan, as well as influencing the interest rates offered by banks on savings accounts.

Hikes in recent years, designed to combat skyrocketing inflation, have left mortgage rates much higher than was normal for most of the last decade.

Social renters, such as people who live in rented council homes, were the next worst affected after private renters, with average inflation of 3 per cent.

The ONS also found that families who are working age faced a higher rate of inflation, at 2.8 per cent, than retired people, at 2.1 per cent.

And households with children saw price rises of 2.8 per cent compared to those without, who saw a 2.6 per cent increase.