Mapped: Which UK cities could be hit hardest by Trump’s tariffs?

The 10 per cent tariff on all imports will see the cost of UK goods rise across the Atlantic, from artisan cheese and beer to cars and machinery.

But the additional 25 per cent tariff on steel and aluminium is set to significantly impact car manufacturing and the British steel industry.

Coventry is the most exposed city, where more than 22 per cent of its total exports are estimated to be goods to the US.

Read the full story here:

Maroosha Muzaffar11 April 2025 07:00

Trump brags in Oval Office that his billionaire pals made a killing in stocks after he pulled the plug on tariffs

President Donald Trump gleefully recounted how much money his billionaire pals made on the stock market after he suddenly suspended most of his worldwide tariffs.

Stocks zoomed Wednesday after Trump pulled the plug on the tariffs.

“THIS IS A GREAT TIME TO BUY!!!!” he urged on Truth Social shortly after the market opened and before he suspended the levies for 90 days just four hours later.

Stocks jumped more than 7 per cent Wednesday within minutes of his announcement suspending the tariff for 90 days. The market ultimately closed more than 9 per cent higher.

At the White House Oval Office that day, Trump pointed to a pair of billionaire visitors.

Read the full story here:

Maroosha Muzaffar11 April 2025 06:45

Indian rupee jumps higher on Friday

The Indian rupee strengthened by 0.8 per cent to 86 against the US dollar on Friday, tracking gains in other Asian currencies as the dollar dropped to a near two-year low.

Traders expect continued volatility, with the rupee likely to consolidate between 85.70 and 86.70 in the short term.

Reuters quoted a trader at a state-run bank as saying that the rupee is currently in “the middle of its recent trading range and it could consolidate between 85.70 and 86.70 in the near term”.

Maroosha Muzaffar11 April 2025 06:30

Apple flew out 600 tons of iPhones from India to the US to ‘beat’ Trump’s tariff deadline

Apple reportedly hurried 600 tons of iPhones — up to 1.5 million individual phones — out of India before President Donald Trump slapped the rest of the world with tariffs.

The tech behemoth chartered flights to India in order to snatch up as many phones as possible, likely to try to build up its US phone inventory.

Indian imports face a 26 per cent tariff rate, but Trump announced a 90-day moratorium on the import tax after he tanked global stock markets with his “Liberation Day” announcement.

Read the full story here:

Maroosha Muzaffar11 April 2025 06:19

Apple has few incentives to start making iPhones in US, despite Trump’s trade war with China

President Donald Trump’s administration has been predicting its barrage of tariffs targeting China will push Apple into manufacturing the iPhone in the United States for the first time.

But that’s an unlikely scenario even with US tariffs now standing at 145 per cent on products made in China — the country where Apple has manufactured most of its iPhones since the first model hit the market 18 years ago.

The disincentives for Apple shifting its production domestically include a complex supply chain that it began building in China during the 1990s. It would take several years and cost billions of dollars to build new plants in the US, and then confront Apple with economic forces that could triple the price of an iPhone, threatening to torpedo sales of its marquee product.

Read the full piece here:

Maroosha Muzaffar11 April 2025 05:58

Gold prices hit record high amid US-China trade tensions

Gold prices soared nearly 3 per cent to a record high of $3,171.49 an ounce on Thursday, as a weakening US dollar and escalating trade tensions — driven by President Trump’s decision to raise tariffs on Chinese goods — pushed global investors toward the safe-haven metal.

Spot gold climbed 2.6 per cent to $3,160.82 an ounce at 1.54pm ET (1754 GMT), after hitting a record high of $3,171.49 earlier in the session.

US gold futures rose 3.2 per cent to settle at $3,177.5.

The dollar’s drop made gold more attractive to non-US buyers, while unexpectedly soft US inflation data and expectations of Federal Reserve rate cuts added momentum.

“Gold regains its safe-haven appeal and gets back on track for new all-time highs,” Nikos Tzabouras, Senior Market Analyst at Tradu.com told Reuters.

“However, prospects of deals with trading partners pose a significant risk to gold’s upside potential, as they could renew pressure on the metal. Additionally, headwinds may arise from pared-back Fed rate cut bets that can strengthen the dollar.”

Maroosha Muzaffar11 April 2025 05:41

Vietnam hoping to negotiate tariffs to around 22-28%

Vietnam is trying to avoid harsh US tariffs by promising to crack down on Chinese goods that are being re-routed through its territory to evade American duties, according to a person familiar with the matter and a government document seen by Reuters.

This reportedly includes clamping down on transhipment fraud (where Chinese goods are falsely labelled as “Made in Vietnam”) and tightening control over sensitive exports to China, such as semiconductors.

Vietnam was recently hit with a 46 per cent tariff by the Trump administration, though it’s been suspended for 90 days pending trade talks.

Vietnam is hoping to negotiate this down to around 22-28 per cent, according to three people with knowledge of the matter, the outlet reported.

Maroosha Muzaffar11 April 2025 05:23

China’s yuan slips to 19-month low against trading partners

China’s yuan rebounded slightly against the US dollar on Friday after hitting its weakest level since 2007, but continued to slide against a basket of major trading partner currencies, reaching a 19-month low.

This comes amid rising US-China trade tensions, with US president Donald Trump increasing tariffs on Chinese goods to an effective 145 per cent, excluding China from a 90-day tariff pause given to other nations.

While a weaker yuan could help boost Chinese exports, the People’s Bank of China (PBOC) is cautiously managing its depreciation to avoid capital flight and financial instability, according to Reuters.

Despite loosening its grip slightly, the PBOC is actively working to stabilise the yuan, the outlet reported, instructing state banks to reduce dollar purchases.

Analysts say that devaluing the yuan relative to a broader currency basket — rather than just the dollar—may help China’s exports stay competitive in non-US markets.

Maroosha Muzaffar11 April 2025 05:14

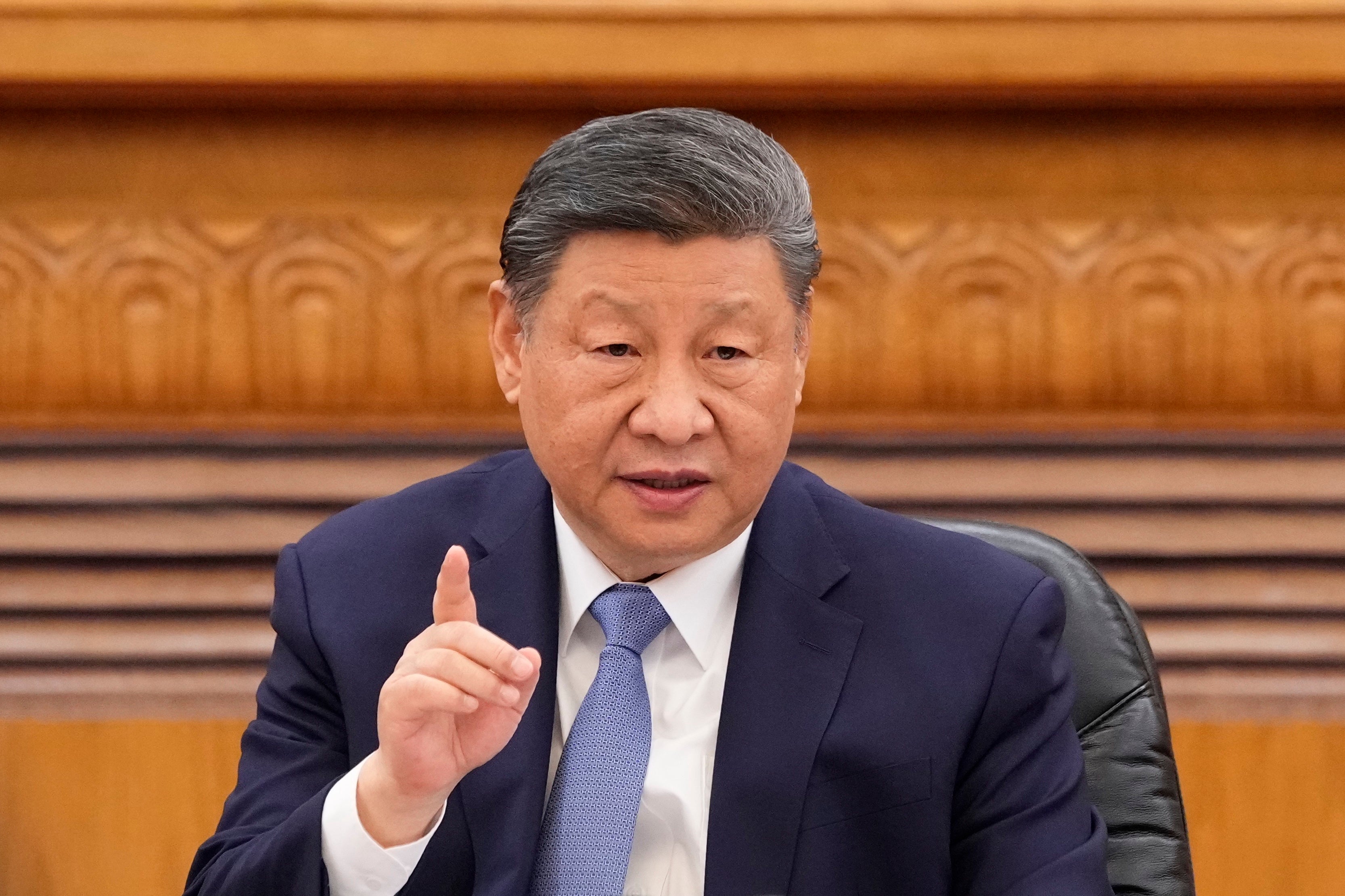

Xi Jinping to visit southeast Asian countries amid escalating US-China trade tensions

Chinese president Xi Jinping will make his first official foreign trip of the year from Monday to Friday, visiting Vietnam, Malaysia, and Cambodia amid escalating US-China trade tensions.

Beijing said Mr Xi is visiting Vietnam at the invitation of president Luong Cuong, marking his first trip there since December 2023.

Mr Xi will visit Malaysia from 15-17 April. The communications minister, Fahmi Fadzil, said Mr Xi’s visit was “part of the government’s efforts … to see better trade relations with various countries including China”.

Mr Xi will travel to Cambodia on Thursday next week and Cambodia described it as a “milestone visit which will further cement the traditional relations of friendship built by successive leaders of both countries”.

Maroosha Muzaffar11 April 2025 04:55

Asian markets tumble after Trump acknowledges ‘transition cost and problems’

Asian markets are mostly trading lower today, dragged down by a wave of risk-off sentiment following Wall Street’s sharp decline.

Japan’s Nikkei 225 is leading the slump with a steep 4.5 per cent fall, while South Korea’s Kospi, Hong Kong’s Hang Seng, and Australia’s ASX 200 are also in the red.

Mainland China and Taiwan, however, are showing some resilience. The Shanghai Composite is up 0.1 per cent and Taiwan’s Taiex has gained 0.2 per cent, offering a slight contrast to the broader regional downturn.

Maroosha Muzaffar11 April 2025 04:37