Legislation in Congress could force Donald Trump’s administration to hand over banking records related to Jeffrey Epstein that allegedly include the names of women and girls he may have trafficked, as well as the identities of people connected to the late sex offender.

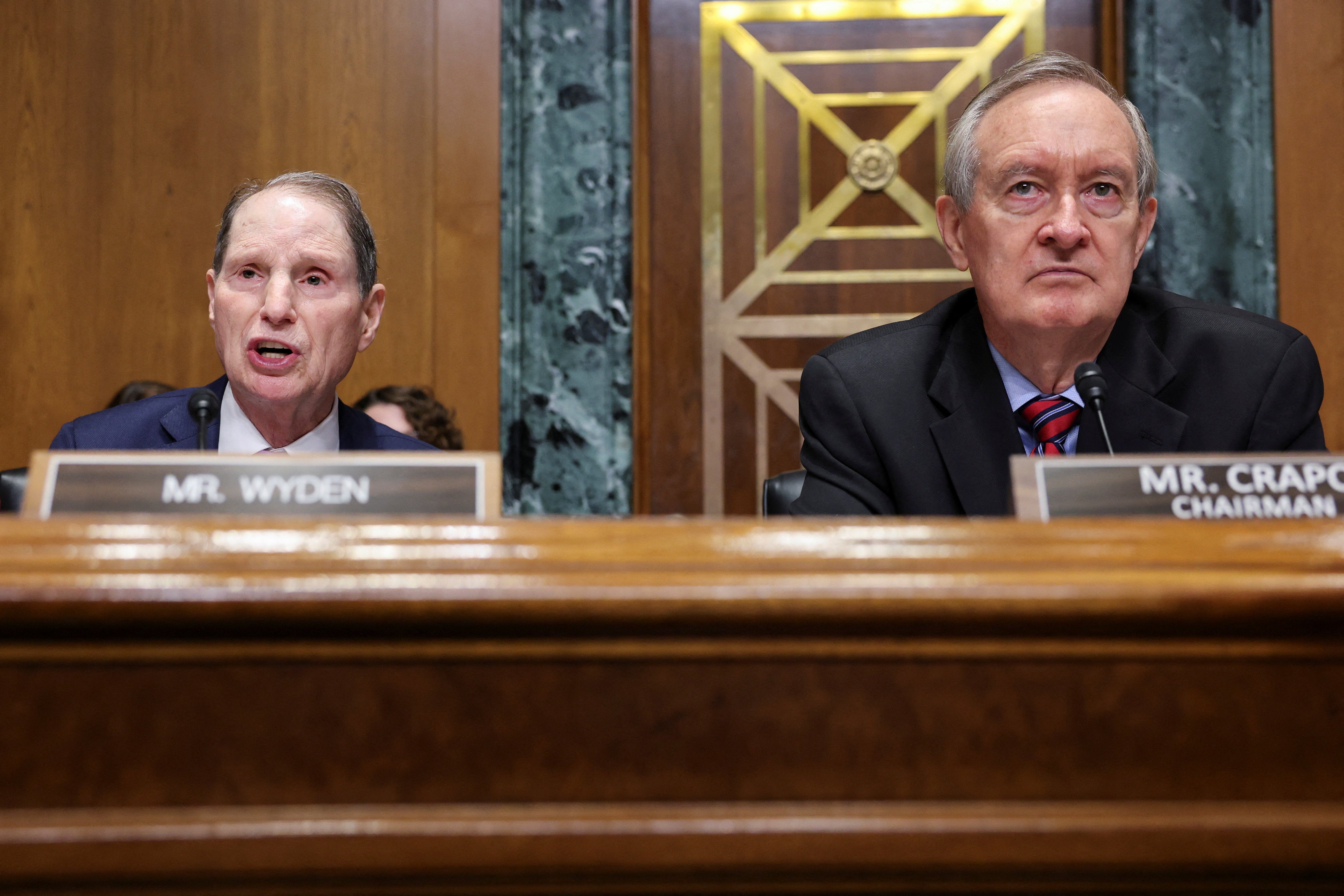

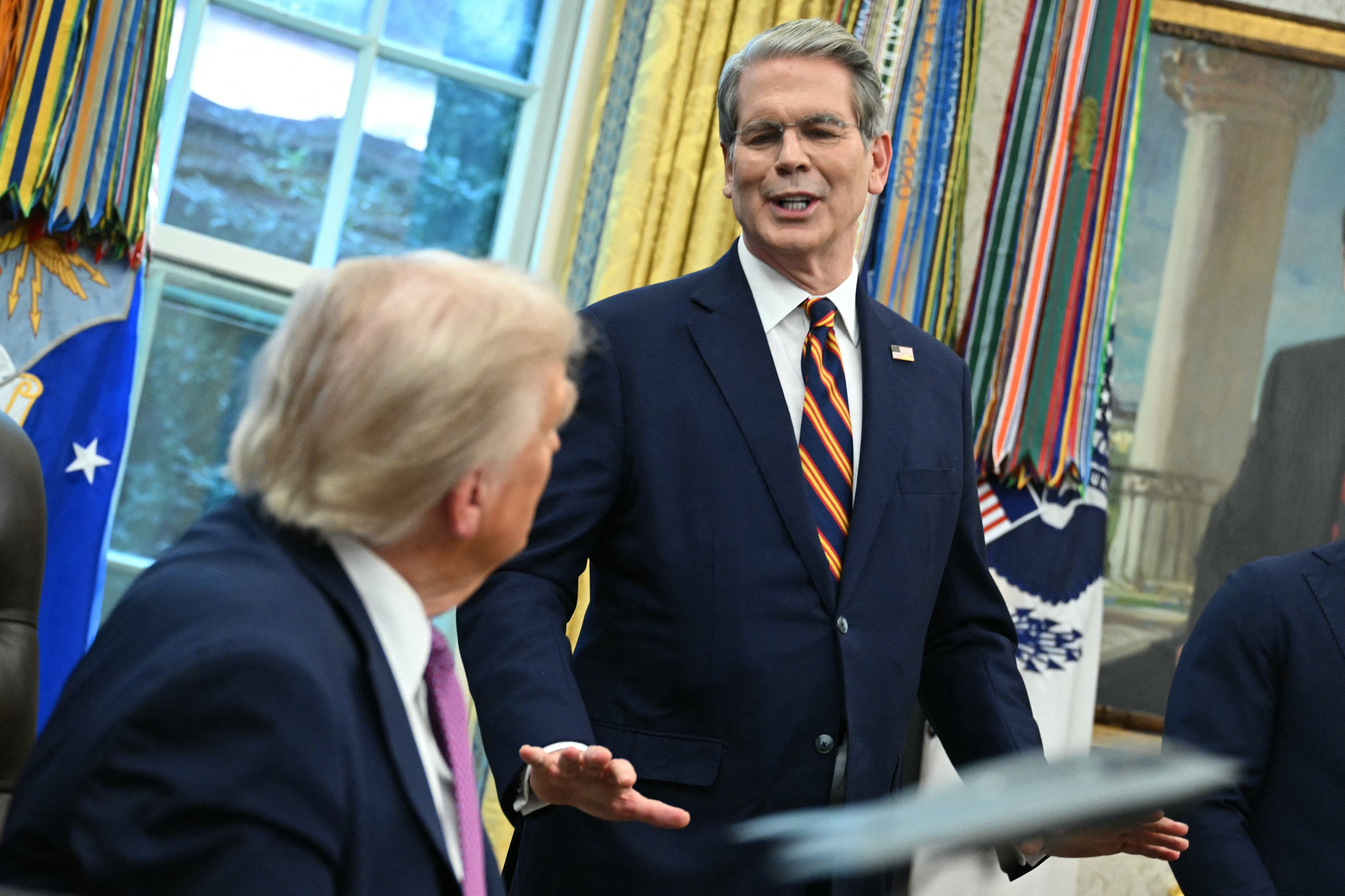

A bill introduced by Democratic Sen. Ron Wyden on Wednesday could compel the Treasury Department to turn over documents to Senate investigators who have been digging into the financial network surrounding Epstein for the last three years. Wyden has said that Trump’s Treasury Secretary Scott Bessent has repeatedly turned down requests to produce documents.

Wyden’s investigation has taken on new urgency under the Trump administration, which insists that the public and press should move on from questions about the case. The Department of Justice stated earlier this year that there is “no basis” to release Epstein documents despite demands for a full accounting of his death and alleged ties to a wider child trafficking conspiracy.

Files sought by Wyden’s office allegedly include Epstein-connected transactions totaling at least $1.5 billion and may reveal potential violations of federal anti-money laundering laws by J.P. Morgan and other banks, according to the senator.

“The basic question here is whether a bunch of rich pedophiles and Epstein accomplices are going to face any consequences for their crimes, and Scott Bessent is doing his best to make sure they won’t,” Wyden said in a statement.

“From the beginning, my view has been that following the money is the key to identifying Epstein’s clients as well as the henchmen and banks that enabled his sex trafficking network,” he added. “It’s past time for Bessent to quit running interference for pedophiles and give us the Epstein files he’s sitting on.”

The Independent has requested comment from the Treasury Department and JP Morgan Chase.

The senator’s Produce Epstein Treasury Records Act will be filed as an amendment to the National Defense Authorization Act, among annual “must-pass” bills in Congress.

The legislation requires the Treasury Department to give Senate committees every “suspicious activity report” connected to Epstein’s accounts, which are recorded by banks as a means of detecting signs of illegal activity for federal law enforcement — as well as several dozen other figures like Ghislaine Maxwell, Epstein’s jailed accomplice, and their banking institutions.

Treasury “must also produce a report with a list of all financial institutions” that filed those reports, as well as a list of “all individuals and entities flagged” by the reports and “the total dollar value” inside of them.

Wyden also is seeking a report that details any and all investigations performed by the Treasury Department into any potential violations of the Bank Secrecy Act “or any other federal law by financial institutions regarding the handling of any accounts” identified in suspicious activity reports connected to Epstein.

Confidential bank reports, filed with the Treasury Department and IRS, could provide a vital look at the massive financing machine behind Epstein’s alleged sex trafficking operation, which spanned New York City, Florida and the U.S. Virgin Islands.

Filings uncovered by the Wyden’s office include $1.5 billion in transactions through four big banks, including wire transfers from wealthy figures over the sales of artwork, fees paid to Epstein, and payments to several women. But the banks appeared to have waited until Epstein’s arrest on federal charges to flag the transactions, according to his office.

The largest suspicious activity report was filed in 2019 by JPMorgan for $1.1 billion, according to the senator.

Other suspicious activity reports include a payment through Deutsche Bank totaling $400 million, $78 million from Bank of New York Mellon and Bank of America’s logs on Black’s payments to Epstein.

In 2023, JP Morgan Chase paid $290 million to settle a lawsuit brought by 200 of Epstein’s victims. The bank paid another $75 million to settle a lawsuit brought by the U.S. Virgin Islands.