The latest statistics from the Office of Rail and Road (ORR) show that train fare revenue between April 2023 and March 2024 rose by 14% to £10.4 billion compared to the previous twelve months, but at a slower rate than passenger journeys, which rose 16%.

Funding from the UK and devolved governments towards the operation of the railway was £12.5 billion, down £0.1 billion compared to the previous twelve months. This is a slower rate of reduction than in previous years.

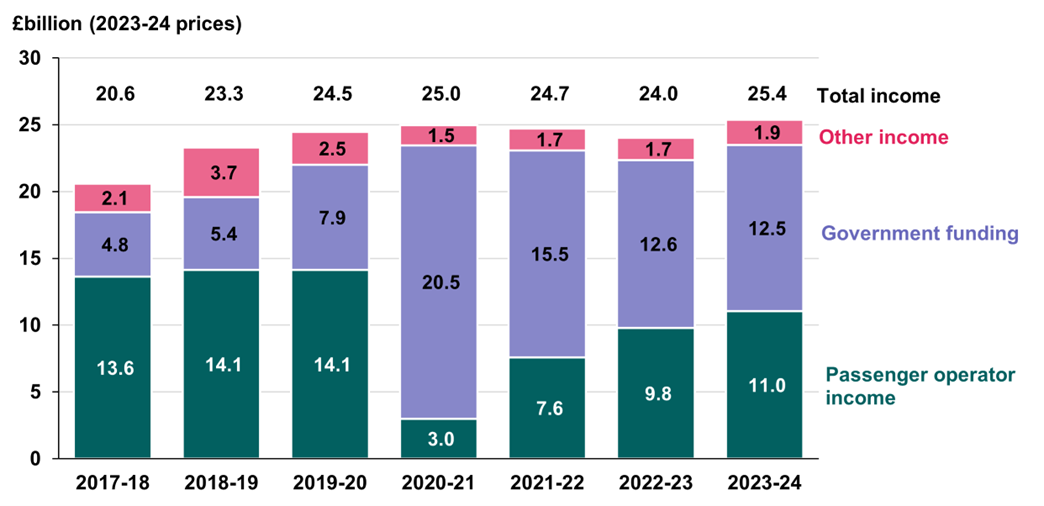

Income for the operational rail industry, UK, annual data, April 2017 to March 2024

ORR’s official statistics also include details on the finances of train operating companies. In the latest year, 11 out of 20 franchised train operators were expected to pay dividends totalling £165 million, an increase of £85 million on the previous year. Publicly owned operators accounted for 13% of this total.

ORR’s Rail Industry Finance (April 2023 to March 2024) statistics shows a breakdown of income, expenditure and government funding for the UK rail industry. The key findings include:

- Passenger journeys are up: 1.6 billion passenger journeys were made in Great Britain,16% more than the previous year, with rail usage continuing to recover from the impact of the pandemic. This is 7% less than the 1.7 billion journeys made between April 2019 and March 2020 (pre-pandemic).

- Fares income is up: Fares income in the latest year was £10.4 billion, up 14% (£1.2 billion, adjusted for inflation) due to the increase in passenger journeys. However, fares income remained 18% below pre-pandemic levels.

- Industry income is up: The industry as a whole received £25.4 billion of operational income in the latest year, an increase of 6% (£1.4 billion, adjusted for inflation).

- Government funding is stable: The UK and devolved governments contributed a total of £12.5 billion to the day-to-day operations of the railway in the latest year, a reduction of 1% (£0.1 billion) from the previous year. Government funding is now at just under half (49%) of operational income.

- Expenditure is down: Operational industry expenditure decreased by 7% to £25.1 billion. Excluding financing costs, expenditure was largely unchanged at £22.5 billion.

- HS2 represents the majority of current railway investment: Investment in new and enhanced rail infrastructure and rolling stock remained largely unchanged at £10.2 billion, an increase of 1% (£0.06 billion). Most of this investment came from investment in High Speed 2 (HS2) at £7.3 billion in the latest year.

- ROSCOs: The total net profit margins of rolling stock companies (ROSCOs) decreased 12 percentage points to 22%. ROSCOs paid £331 million in dividends to shareholders, a reduction of 39% (£211 million) compared with the previous year.

Will Godfrey, Director of Economics, Finance and Markets said: