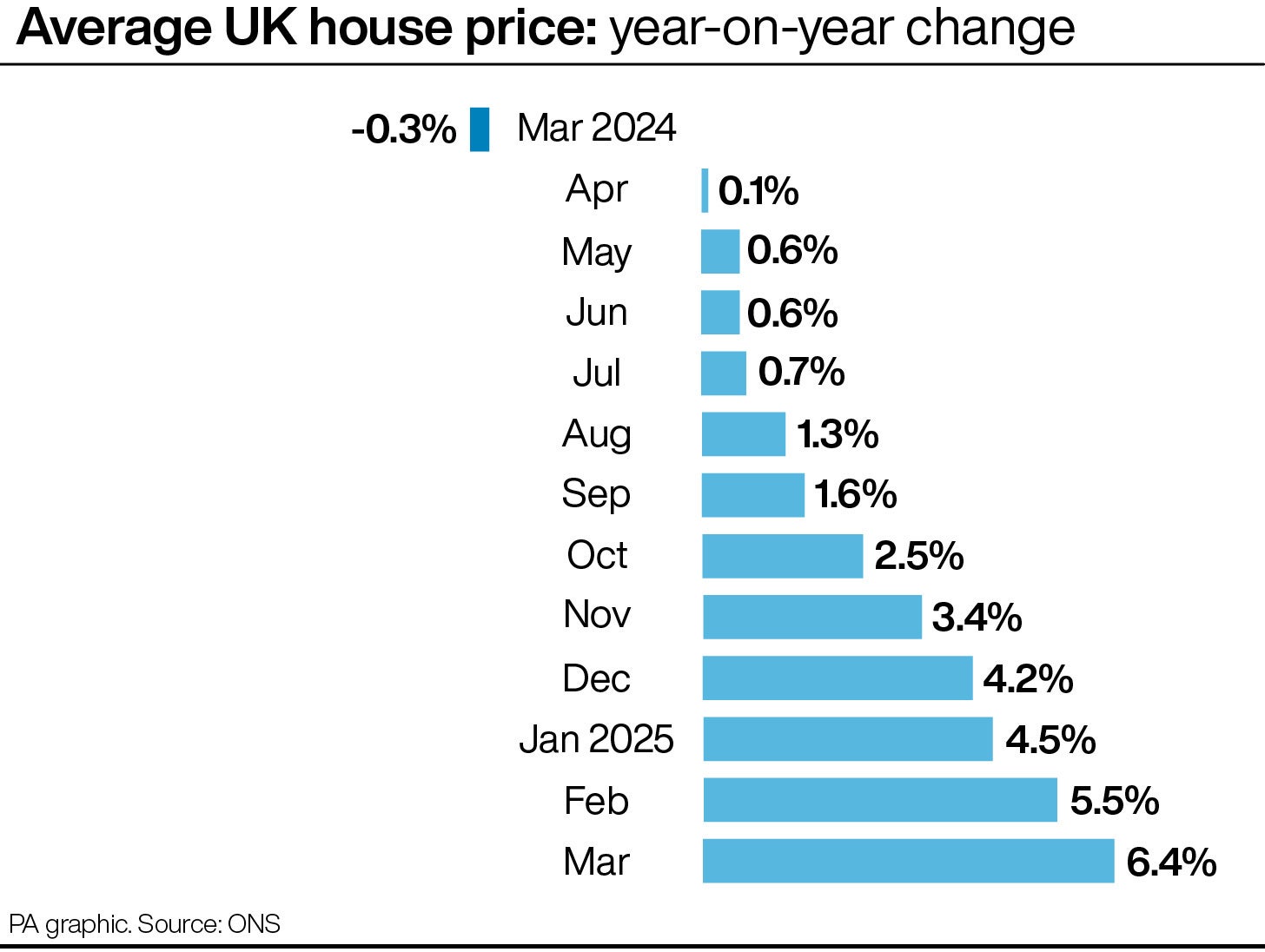

UK house prices surged 6.4 per cent annually in March, reaching an average of £271,000, according to the Office for National Statistics (ONS).

This acceleration from February’s 5.5 per cent growth coincided with a rush of homebuyers seeking to complete purchases before the April conclusion of a stamp duty holiday in England and Northern Ireland.

This surge in the housing market comes as UK inflation hit a 15-month high, adding further pressure on household finances already grappling with rising living costs.

The Consumer Prices Index (CPI) revealed inflation jumped to 3.5 per cent in April, exceeding economists’ predictions of 3.3 per cent and significantly up from March’s 2.6 per cent.

This inflationary spike, coupled with various bill increases in what has been dubbed an “awful April”, paints a challenging picture for household budgets.

The ONS data highlights the interplay of market forces, government policy, and economic trends impacting personal finances across the UK.

Andrew Montlake, chief executive at Coreco mortgage brokers, said: “With inflation edging up sharply this morning, and mortgage rates likely to follow as expectations of further base rate cuts reduce, this could see average values start to retreat again. If prices do start to ease, they will only go so far as there is a fundamental lack of supply.”

Jonathan Handford, managing director at estate agent group Fine & Country, said: “In the months ahead, inflation and still-elevated borrowing costs are likely to weigh on demand, particularly as affordability remains stretched across much of the country.

“That said, a period of softer or stabilising house prices may offer a welcome opportunity for first-time buyers who have been priced out in some areas of the country.”

Sarah Coles, head of personal finance at Hargreaves Lansdown, said the “rush to seal a deal” before the end of the stamp duty holiday provided some extra impetus for the housing market.

She added: “This may well slow again in the next set of figures, which is the usual pattern in the aftermath of a stamp duty holiday. However, we’re unlikely to see anything too dramatic.

“This period has been marked by robust price growth rather than stellar leaps, so the hangover from the property party is likely to be less painful.

“Lower mortgage rates should also help support prices. However, with buyer numbers likely to have dropped off fairly sharply, there’s going to be some room for negotiation.”

Nick Leeming, chairman of estate agent Jackson-Stops, said: “Encouragingly, across the Jackson-Stops network we are seeing robust activity levels, with demand outpacing supply in popular markets. In April alone, an average of five potential buyers were competing for every new listing, underscoring borrowers’ continued commitment.”

Jeremy Leaf, a north London estate agent, said some potential buyers and sellers are “sitting on their hands”, adding: “The recent cut in mortgage rates has restored some confidence but April’s sharp rise in inflation will not help.”

Average house prices increased to £296,000 (6.7 per cent annual growth) in England, £208,000 (3.6 per cent) in Wales, and £186,000 (4.6 per cent) in Scotland, in the 12 months to March, according to the ONS.

The average house price in Northern Ireland was £185,000 in the first quarter of 2025 – a 9.5 per cent annual increase.

Iain McKenzie, chief executive of the Guild of Property Professionals, said: “We cannot ignore the subdued economic backdrop and ongoing geopolitical uncertainties which will likely ensure a more measured pace of growth for the remainder of the year.”

Richard Harrison, head of mortgages at Atom bank, said: “Lenders have been incredibly active in reducing rates.”

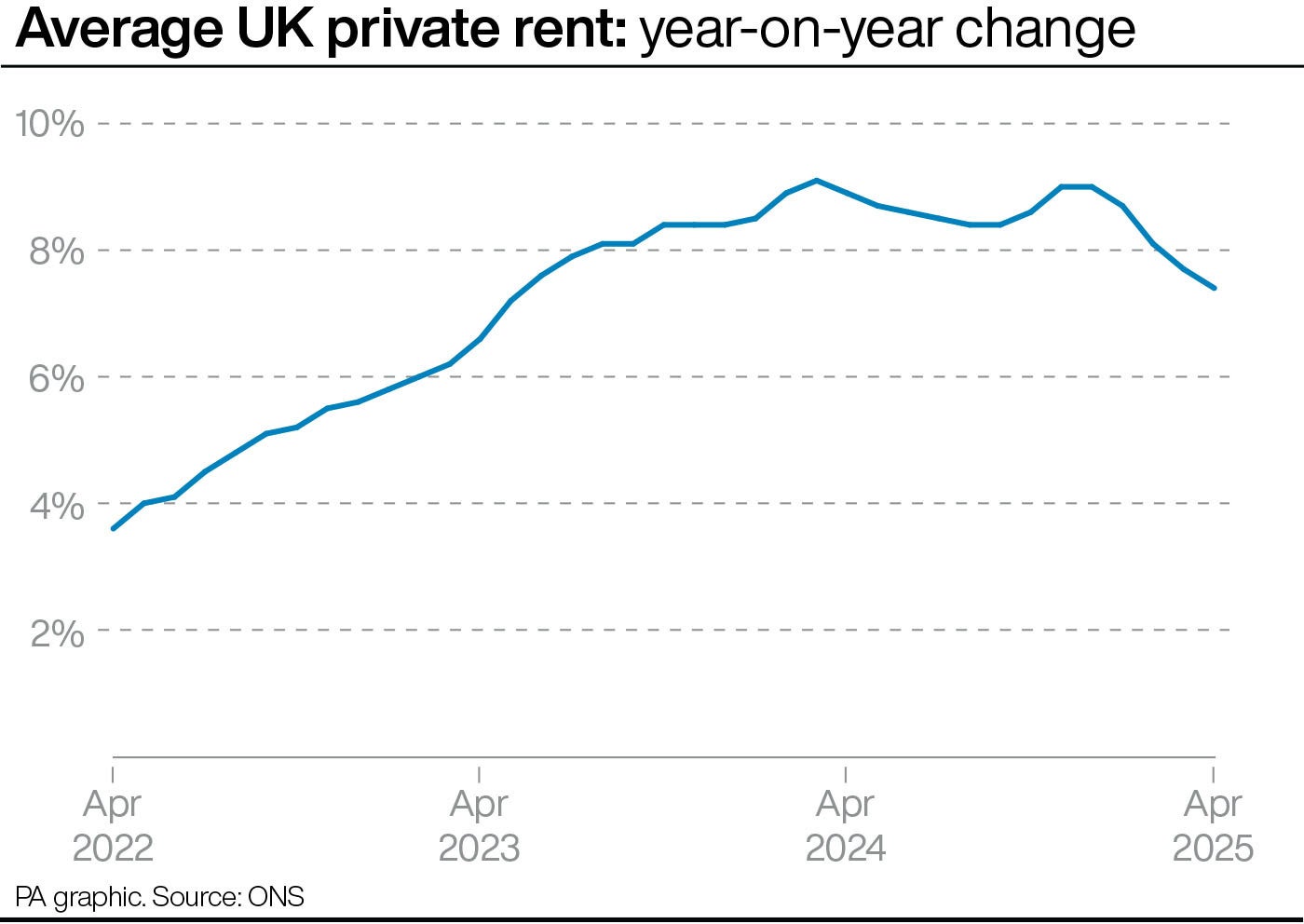

The ONS also said average UK monthly private rents increased by 7.4 per cent, to £1,335, in the year to April. The annual growth rate eased from 7.7 per cent in March.

Average rents increased to £1,390 per month (7.5 per cent annual growth) in England, £795 (8.7 per cent) in Wales, and £999 (5.1 per cent) in Scotland, in April.

In Northern Ireland, average rents increased to £843 (7.8 per cent annual growth) in the 12 months to February, the report said.

Within England, annual inflation in private rents was highest in the North East region (9.4 per cent) and lowest in Yorkshire and the Humber (4.0 per cent), in April.

Nathan Emerson, chief executive of property professionals’ body Propertymark, said: “Overwhelming demand within the rental sector continues to influence price increases for those who rent. We continue to witness, on average, around 10 applicants for every property available to rent and this is a situation that has broadly remained stagnated across the last five years.

“It is imperative that rental supply rises to meet the challenges of demand.”