One of the world’s largest banks detected “suspicious activity” on Jeffrey Epstein’s account and took decisive action — nearly 20 years ago, according to a new report.

In 2007, an HSBC branch in Paris notified Epstein that it was ending its business relationship after evidence of money laundering and other misconduct came to light, according to Bloomberg.

It’s notable as it’s the sole known instance of a major financial institution cutting ties with the disgraced financier prior to 2008, when he pled guilty to procuring minors for prostitution in Florida.

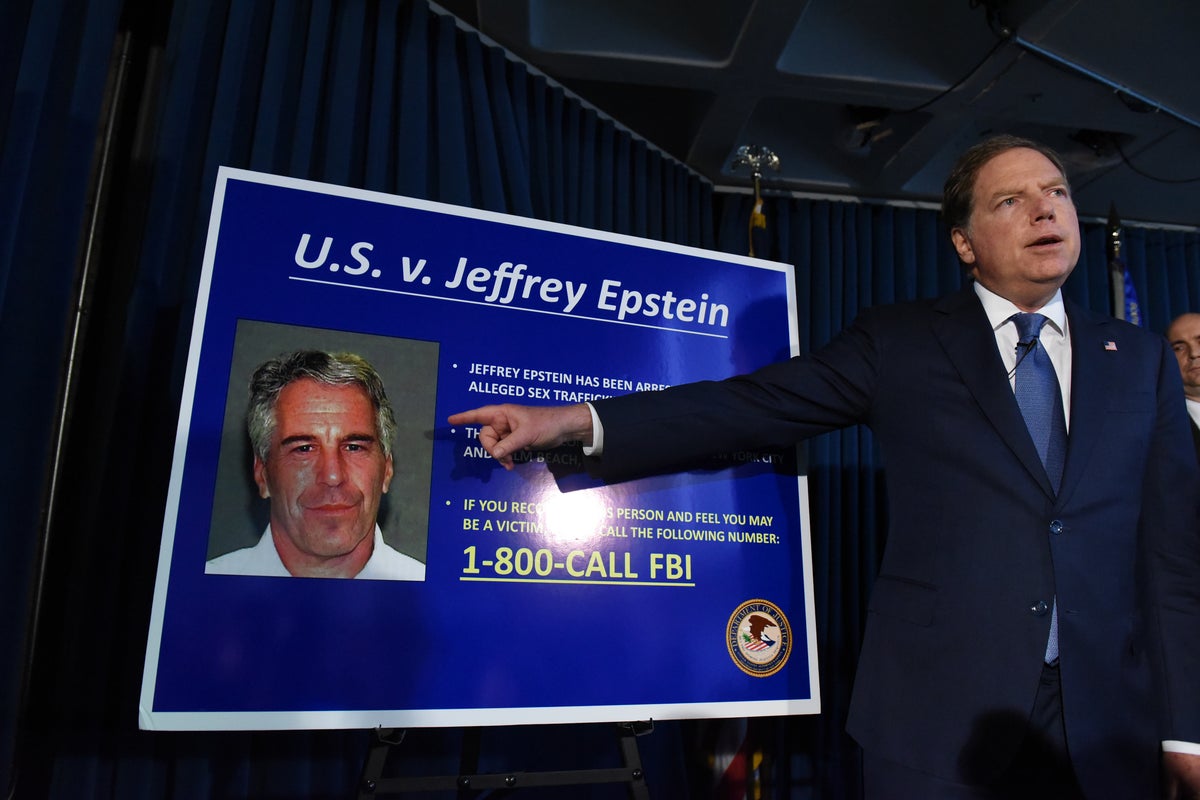

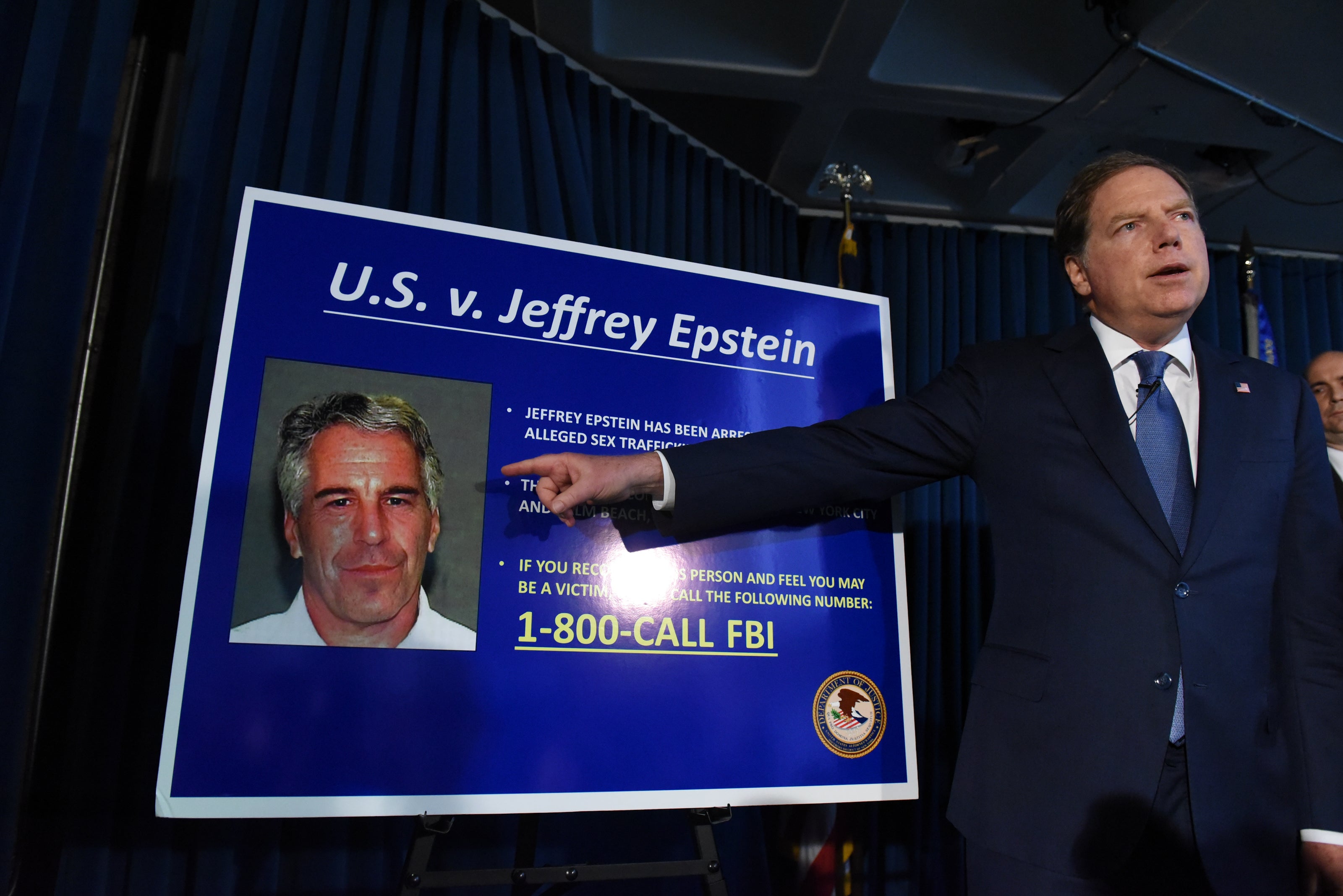

The previously unreported termination comes as public scrutiny into Epstein — who died in 2019 while awaiting trial — escalates to new heights.

On Wednesday, President Donald Trump signed the Epstein Files Transparency Act, requiring the Department of Justice to release its files on the late sex offender. He also instructed Attorney General Pam Bondi to investigate Epstein’s involvement with former President Bill Clinton and other prominent individuals.

Earlier in November, a House committee published a trove of some 20,000 documents from Epstein’s private estate, including several emails from Epstein in which he claimed Trump “knew about the girls” and “spent hours” with a victim.

The Republican president, who used to socialize with Epstein, has consistently maintained he did nothing wrong and described the accusations against him as a “hoax” perpetuated by Democrats.

‘Suspicious activity’

A few days before Christmas in 2007, the HSBC’s branch in Paris — where Epstein owned a palatial apartment — sent him a letter.

“We hereby inform you that we do not intend to maintain our relationship and notify you this day, subject to a one month notification period, the end of our banking contract,” an English translation of the document read.

“Consequently, after this period is over, you should return all unused checks still in your possession and provide us with your new banking references,” the letter, obtained by Bloomberg as part of a cache of Epstein’s personal emails, continued.

The letter did not provide a reason for the abrupt action. However, two unnamed individuals with knowledge of the matter told the outlet that it came after compliance staff noticed suspicious activity.

Specifically, they became concerned over financial transactions related to young women linked with a French modeling agency owned by Jean-Luc Brunel. A longtime friend of Epstein’s, Brunel died in prison in 2022.

Compliance employees also observed that Epstein’s account “had numerous round-dollar deposits” and that withdrawals “bore hallmarks of money laundering and other financial misconduct.”

A few weeks later, Epstein’s personal attorney, Darren Indyke, informed the late sex offender of the bank’s decision. He wrote in an email that Epstein’s legal representative in France asked the HSBC branch for an explanation.

The representative “asked if it was maybe an Arab/Jewish thing or something about Epstein that the bank does not like,” Indyke wrote, adding that after this, “the bank representative got nervous…”

There is no record of a response from Epstein, Bloomberg reported. The outlet noted that Epstein maintained at least one other account with HSBC in Switzerland.

The revelation comes as major banks that associated with Epstein have come under scrutiny by Congress.

This week, Democratic Sen. Ron Wyden released a memo accusing JP Morgan Chase of systematically underreporting dubious activity linked to Epstein’s accounts over nearly 20 years.

The memo said that the bank reported just $4.3 million in transactions from the disgraced financier’s accounts between 2002 and 2016. But, after Epstein was arrested in 2019, the bank reported moving $1.3 billion to and from his accounts.

“In other words, the cumulative dollar value of the suspicious transactions the bank reported after Epstein’s death in federal custody was nearly 300 times greater than the value of the transactions it flagged while he was alive and actively trafficking women and girls,” the memo said.

In 2023, JP Morgan agreed to pay $75 million to settle civil claims for its role in allowing Epstein to fund his sex-trafficking ring.

A spokesperson for HSBC declined to comment when contacted byThe Independent, and a JPMorgan Chase representative did not immediately respond.