In September, SLC will pay approximately £2.2billion in maintenance payments to almost one million students as they start and return to university. However, at this time of year, students can be targeted by scammers, with text message (SMS) fraud currently the most popular form of scam.

Alan Balanowski, Risk Director at SLC, said “SLC’s mission is to support students to invest in their future and being at university is a very exciting time – but it’s vital that they also remain vigilant and aware of scams as they start or return to university.

“The methods used by fraudsters are constantly evolving, with more sophisticated and different technologies being used to target students. This is especially true around the start of the academic year, when the first payments are being made. Scammers are well aware that students will be starting to receive their maintenance loan from us and over the last two years we have seen a rise in attempts to defraud students, including people impersonating SLC or students via phone calls (vishing), contact by text message (smishing) or via emails (phishing).

“We have a range of prevention methods that we use to identify and stop scammers and last year, we stopped £45.5m being stolen from students. We are committed to protecting students, however, it’s vital that they can spot signs of a scam and act to protect themselves and their money from falling into the wrong hands. Our message to students is simple – think before you click.”

SLC’s top tips for identifying and stopping a scam

- Check the quality of the communication – misspelling, poor punctuation and bad grammar are often tell-tale signs of phishing.

- Keep an eye out for any emails, phone calls or SMS messages you think are suspicious, especially around the time you’re expecting a payment.

- Scam emails and text messages are often sent in bulk to many people at the same time and are unlikely to contain both your first and last name. These commonly start – ‘Dear Student’ – so be on guard if you see one like this.

- Messages that convey a sense of urgency are also unlikely to be genuine – for example ‘failure to respond in 24 hours will result in your account being closed’.

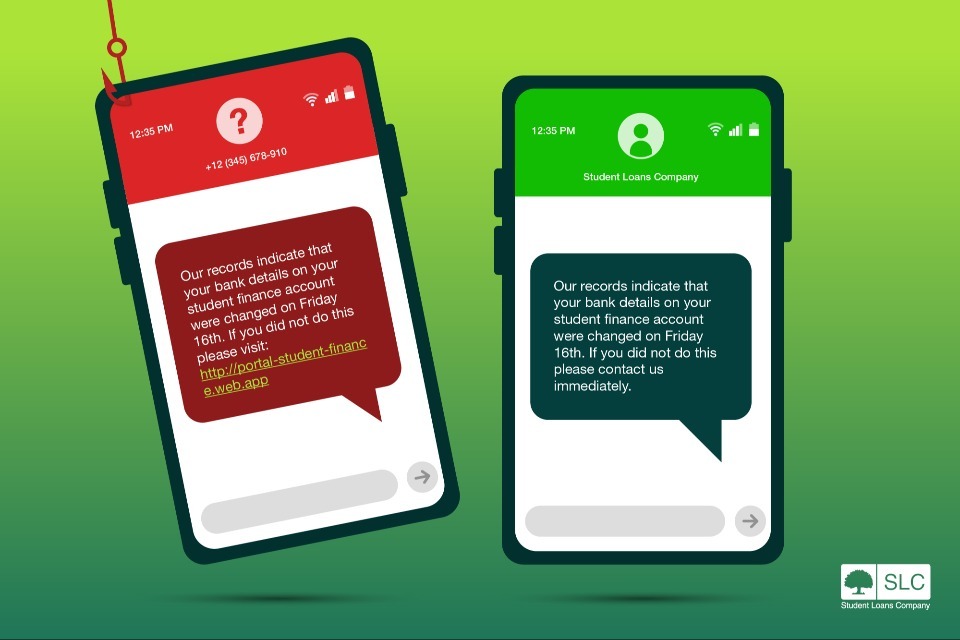

- Think before you click. If you receive an email or SMS that contains a link that you’re not sure of, then hover over it to check that it goes where it’s supposed to. If you’re still in any doubt don’t risk it, always go direct to the source rather than clicking on a potentially dangerous link.

- Scammers can use a variety of methods to try and get you to pay money or share personal details, including the use of fraudulent phone calls, social posts and direct messaging on digital platforms. If you are suspicious of being contacted, always use official phone numbers, your online account and official communication channels to verify the contact you received is genuine.

- Students should also be mindful of the information that they share about themselves on social media, and elsewhere online, to help guard against identity theft. Identity theft happens when fraudsters access information about a person’s identity, such as their name, date of birth, customer reference number, course information or their current or previous addresses to impersonate them online and over the phone.

- Check out our guide to identifying a scam at www.gov.uk/guidance/phishing-scams-how-you-can-avoid-them

SLC also has a range of methods to protect students, including sending a SMS to customers in England if a change has been made to their banks details and asking them to confirm the change. If a customer hasn’t changed their details but receives a message, they should log into their online account to review their information.

SLC will also never ask students to provide their personal or financial information via email or text message. If a student receives a suspicious message, they should report it to SLC’s Economic Crime Unit immediately by emailing [email protected] and calling the dedicated hotline on 0300 100 0059. Neither SLC or Student Finance England (SFE) provide any services through WhatsApp and will never initiate contact with a student through social media channels to discuss their application or student finance entitlement. If a customer receives a communication from SFE that they are unsure of, they should log into their online account to verify if it’s genuine.

There is also a range of additional advice and information on recognising and avoiding scams from Action Fraud, the UK’s national reporting centre for fraud and cybercrime, as well as Stop! Think Fraud, a campaign from the Home Office.