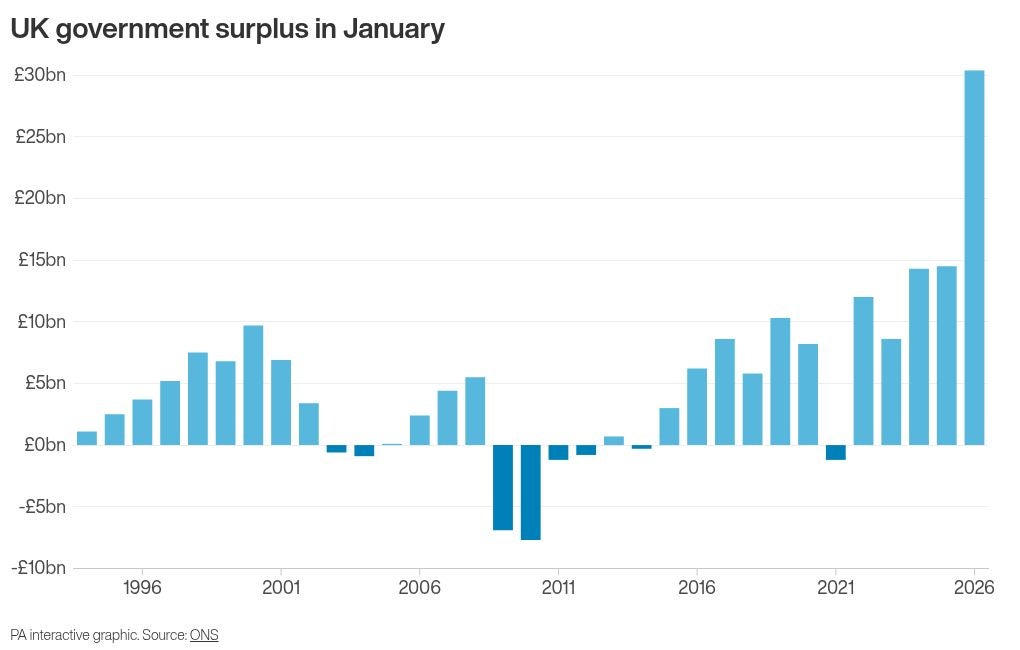

Rachel Reeves has been handed a rare boost after Britain posted its biggest ever borrowing surplus since records began.

The latest official figures from the Office for National Statistics (ONS) showed there was a public sector net borrowing surplus of £30.4bn in January.

It is the highest borrowing surplus – when the government receives more in tax and other revenues than it spends – for any month since records began in 1993.

In what will be a relief for the chancellor as she prepares to deliver the spring statement, the surplus was £6.3bn bigger than predicted by the Office for Budget Responsibility (OBR) and £15.9bn higher than the same month a year ago.

The rise was sparked by a jump in self-assessed tax payments and a fall in debt interest to the lowest level for almost six years.

ONS chief economist Grant Fitzner said: “January – which is traditionally a strong month for self-assessed tax receipts – saw the highest surplus since monthly records began.

“Revenue was strongly up on the same time last year, while spending was little changed, due to lower debt interest payments largely offsetting higher costs on public services and benefits.

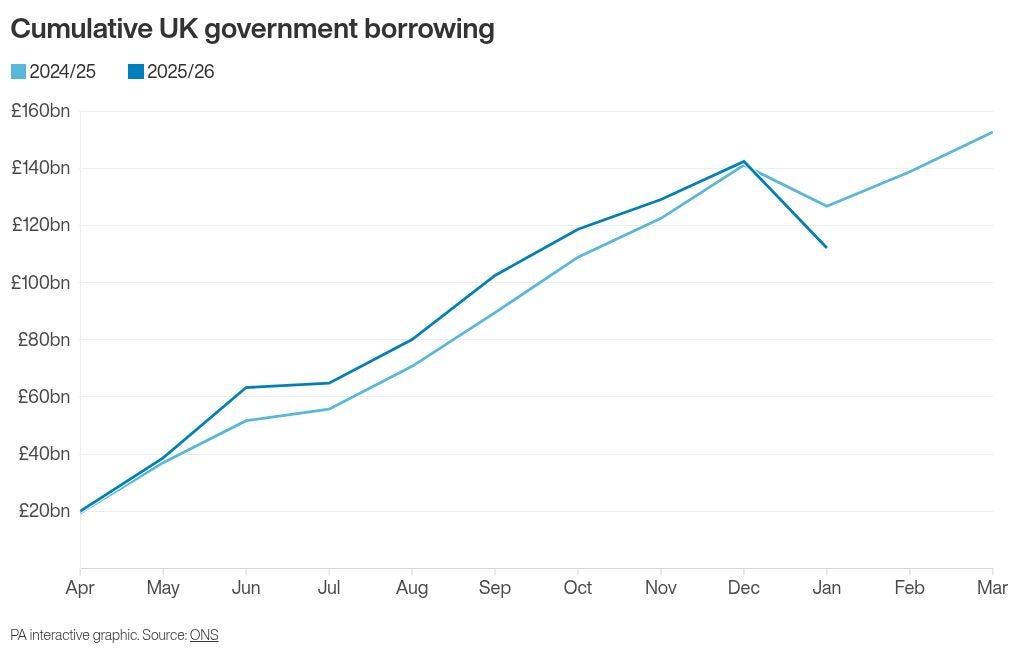

“Across the first 10 months of the current financial year, borrowing is lower than the same period a year ago.”

It came after the government received a record tax take of £109.7bn for January, the ONS said.

The government brought in more tax revenue via capital gains tax, rising by £7bn to £17bn for the month, surpassing forecasts.

This increase was linked to a rise in capital gains tax for most assets in the Labour government’s first autumn budget in 2024.

Friday’s data also showed that self-assessment income tax receipts lifted by £3.6bn to £29.4bn for January, again beating OBR forecasts.

Meanwhile, government spending edged slightly lower – by £0.6bn – to £86.1bn for the month.

This was supported by a drop in debt interest costs, with recent falls in interest rates helping to bring these payments down by £5bn to £1.5bn – the lowest level since March 2020.

The latest figures point towards a strengthening of the state finances, in the final borrowing data before Ms Reeves reveals her spring statement on March 3.

Chief Secretary to the Treasury James Murray said: “We have the right plan to build a stronger, more secure economy.

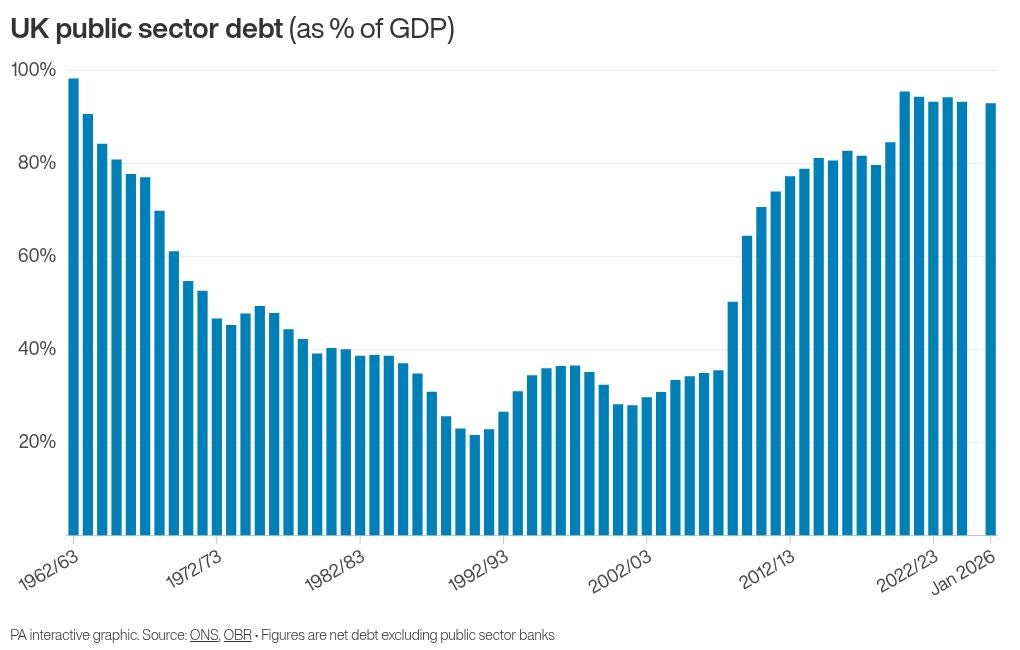

“We have doubled our headroom, we are bringing inflation down, we are making sure that taxpayers’ money is spent wisely, and borrowing this year is forecast to be the lowest since before the pandemic.”

Sir Mel Stride, shadow chancellor, said: “Labour have borrowed £112.1 billion so far this year – the fifth highest borrowing on record.

“Record high taxes and irresponsible spending have weakened the economy.”