When most people think of banking, they think of money, transactions, and interest rates—not carbon footprints, renewable energy, or social equality. But in an era where climate change and social responsibility are in the global spotlight, the financial sector has an increasingly central role to play in creating sustainable change.

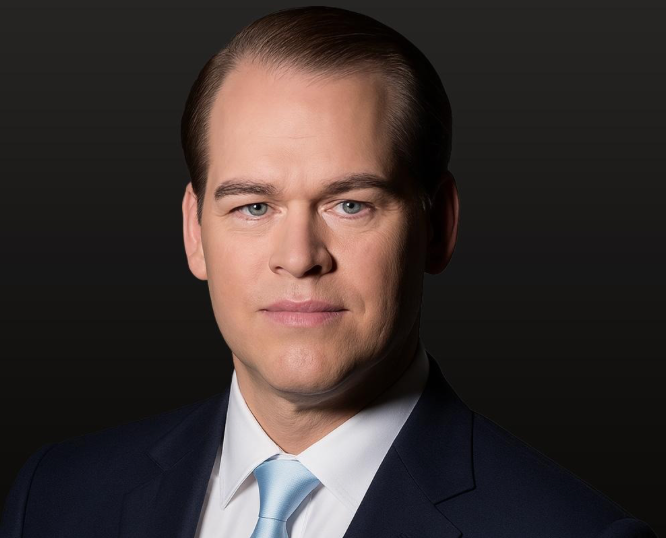

At the forefront of this shift is Michael Gastauer, founder and CEO of Black Banx. Since launching the Toronto-based digital bank in 2015, Gastauer has not only built one of the world’s fastest-growing fintechs—84 million customers, USD 4.1 billion in Q2 2025 revenue, and operations in 180+ countries—but has also embedded environmental, social, and governance (ESG) principles into the very foundation of the company.

For Gastauer, banking is more than just moving money—it’s about moving the world toward a greener, more equitable future.

Why ESG in Banking Matters Now More Than Ever

Historically, banks have been slow to embrace ESG, partly because sustainability initiatives were seen as a “nice-to-have” rather than a business imperative. But mounting public pressure, regulatory demands, and the visible effects of climate change have changed the equation.

According to the 2025 Global Sustainable Finance Report:

- 72% of consumers now consider a bank’s ESG commitments before opening an account.

- Over 60% of investors prioritize ESG-friendly institutions for long-term portfolio stability.

- Financial services are projected to be one of the top three industries influencing global sustainability outcomes by 2030.

Gastauer recognized this trend early and saw an opportunity to not just keep pace with ESG standards—but set new ones.

From Paperless Banking to Carbon Accountability

Black Banx’s ESG strategy isn’t a marketing afterthought—it’s part of its operational DNA. From the start, the company eliminated physical branches, paper-based forms, and unnecessary in-person bureaucracy. This not only reduced operating costs but also cut the bank’s carbon footprint dramatically compared to legacy institutions.

Today, Black Banx’s ESG-driven services and policies include:

- Paperless Onboarding & Operations – Digital account opening in under a minute, zero printed documents.

- Remote-First Workforce – Reduces employee commuting emissions while enabling global talent diversity.

- Green Data Hosting – Partnering with data centers powered by renewable energy.

- Carbon Neutral Commitment – Offsetting emissions from servers, payment processing, and corporate travel.

- Financial Inclusion Programs – Extending services to underserved regions, particularly in Africa, Latin America, and Southeast Asia, to promote economic equality.

The “S” in ESG: Inclusion as a Growth Engine

For Gastauer, environmental action is only one pillar. Social responsibility is equally critical. By serving clients in 180+ countries, including emerging economies often excluded by traditional banks, Black Banx is turning inclusion into a competitive advantage.

In 2024 alone, the company recorded a 32% increase in SME clients from Africa and the Middle East, regions where traditional banks are often absent due to high infrastructure costs. These efforts not only open new revenue streams but also empower local economies—creating a ripple effect of opportunity.

Governance That Builds Trust

Governance often gets less attention than the “E” and “S,” but Gastauer sees it as the glue that holds ESG together. Black Banx maintains strict compliance with global financial standards, including AML, KYC, PCI DSS 3.2, and ISO 20022. Advanced fraud detection, multi-factor authentication, and biometric security make ESG not just about ideals but about accountable, ethical operations.

Real-time fraud detection, biometric authentication, and encrypted infrastructure ensure that clients’ funds and data remain protected—a necessity in a digital-first environment.

Proving That ESG and Profitability Go Hand-in-Hand

Some critics argue that ESG compromises profitability, but Black Banx’s results tell a different story:

- USD 1.5 billion pre-tax profit in Q2 2025

- 13% quarterly user growth

- Cost/income ratio at 64%—down from 89% in 2023

For Gastauer, the lesson is clear: when ESG is integrated into strategy—not bolted on—it fuels innovation, builds customer trust, and accelerates growth.

A Blueprint for the Future of Banking

Michael Gastauer’s ESG vision is proving that fintechs can grow rapidly while actively contributing to global sustainability. By combining strong financial performance with a measurable social and environmental impact, Black Banx is setting a precedent for what the future of banking should look like: fast, inclusive, transparent, and environmentally conscious.

With the company on track to surpass 100 million customers by year-end, its influence—and responsibility—will only grow. As Gastauer continues to push for innovation rooted in ESG values, Black Banx is not just redefining banking for a connected world; it’s shaping a greener, fairer financial future.