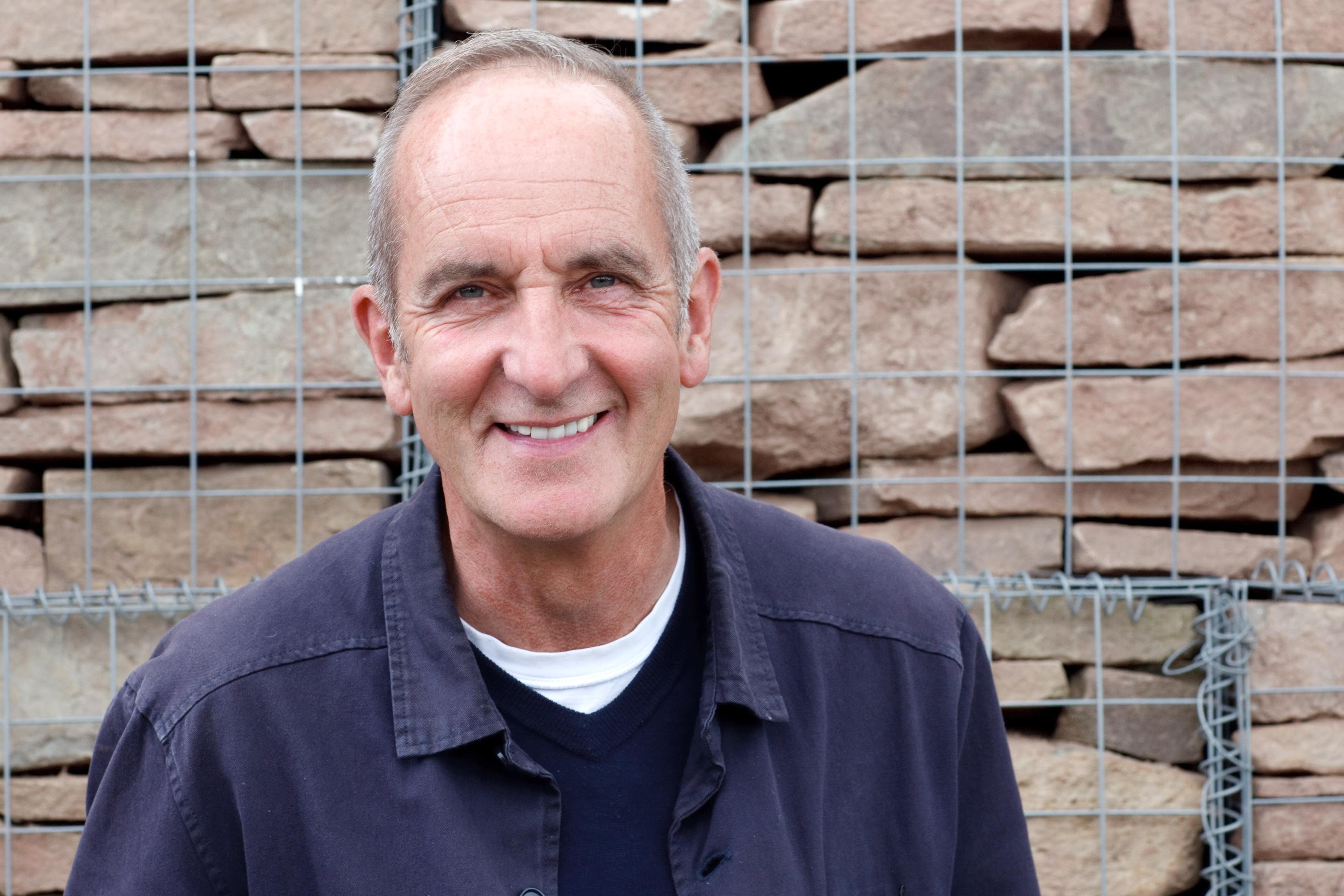

Grand Designs presenter Kevin McCloud has said he feels sorry for anyone who’s trying to buy a home in 2025 due to the “powerful companies” driving up prices.

The 66-year-old, who has hosted the Channel 4 series since it first aired in 1999, revealed that a two-bedroom house he bought for £60,000 in the neighbourhood of Dulwich could cost up to 20 times more today.

He said that similar homes are now being sold for around £1.2m, telling The Times: “Nobody can afford that.”

McCloud continued: “Back in the day, a house cost three or four times what you were earning a year. Now, in central London and the home counties, a house is up to 14 times the average income.

“The entire housing market is controlled by a few extremely powerful companies. They’re a potent lobbying force who are focused on one thing alone – delivering returns to shareholders.

He said the UK now pays some of the highest prices in Europe for our housing stock, which he said was of the poorest quality.

The average UK house price surged to a new high of £299,331 in August, marking the third consecutive monthly increase, according to Halifax.

London remains the most expensive part of the UK, despite modest growth annually, with an average property value of £541,615.

McCloud’s remarks about the UK housing market come after a new mortgage offering first-time buyers the chance to borrow up to 98 per cent of a property was announced by Newcastle building society.

However, in order to be eligible for the loan, buyers cannot get help with their deposit from the “bank of mum and dad” and instead must have saved to get on the housing ladder.

Last year, the estate agent Savills found that just over half (52 per cent) of last year’s 173,500 first-time buyers received parental assistance.

The Independent’s James Moore wrote of the new initiative: “I hope it proves successful and that others dip their toes into these waters, which will bring prices down. There is a need for more like this to level a playing field in which the have-nots are left slogging through thick mud.”