Donald Trump’s decision for the US to bomb Iran has seen fears of a crisis in the Middle East deepen, with the world braced for a counter attack from Tehran.

In one retaliatory move, the country has already voted to shut down a key shipping route, the Strait of Hormuz, prompting warnings of another spike in oil prices.

The price of oil has been on the rise over the past three weeks – amid Israel strikes on Iran’s nuclear sites – but there are concerns it could rocket even further, with one expert warning of a possible 40 per cent increase.

As well as the effect on the price of gas and petrol, any move from Iran to close the shipping route could also affect the likes of transport, production and inflation domestically.

Why do oil prices rise and fall?

When talking about the price of oil, what we’re typically looking at in the UK is Brent Crude, which relates to oil from the North Sea and is a worldwide benchmark of future prices of oil across most markets. There are others, such as WTI, but Brent is typically the focus.

Brent was above $122 per barrel in 2022, a result of the Russian invasion of Ukraine which resulted in far higher energy costs, while the price was as low as $25 in mid-2020 when the Covid lockdown meant demand was incredibly low. Right now, it’s just under $78.

Like any market, a commodity like oil is primarily subject to supply and demand. Too much supply will lower prices so businesses buy it up; if there’s more demand, prices can increase accordingly.

But oil is subject to many other factors.

Opec (the Organisation of the Petroleum Exporting Countries) can decide supply by setting quotas on barrels produced, while weather conditions can also affect production. The various costs of doing business in different parts of the world can also impact the supply line.

What’s the situation with Iran and Strait of Hormuz?

Israel sent rockets into Iran on June 13, before President Trump demanded “not a ceasefire, a real end” to the conflict. Following that, the US fired their own missiles into Iran across the weekend, hitting nuclear facilities and prompting the Asian nation to threaten retaliation.

While the attacks centre around Iran’s nuclear production, oil prices are impacted because that nation controls the Strait of Hormuz, a key shipping route for around 20m barrels a day, as well as producing more than 1.5m barrels of oil a day themselves.

Should Iran opt to close the Strait due to escalated warfare, the restriction of oil supply would therefore be expected to see prices rise further – but so far markets aren’t necessarily predicting that.

“Oil and gas prices are staying very calm, all things considered, and the gains in the immediate aftermath of the American bombings in Iran are perhaps more muted that you might have expected,” said Russ Mould, investment director at AJ Bell. Mr Mould suggested factors such as political interventions or Iran’s lack of response so far may be a reason for that.

Goldman Sachs has warned the price of Brent could rise to $100 and even peak at $110 if the Strait was closed and flows were cut by half for a month, then remained lower than usual for the rest of the year.

Perhaps significantly, the investment bank analysts rate the chances of a closure of the Strait at 52 per cent at present.

What rising oil prices mean for consumers

The immediate link is of course regarding the price of fuel for vehicles, but that’s not the only factor at play.

“Where oil and gas go, petrol and energy prices may follow, but regulators and consumers are watching and it may take a period of sustained strength or weakness for the forecourts to show big changes,” explained Mr Mould.

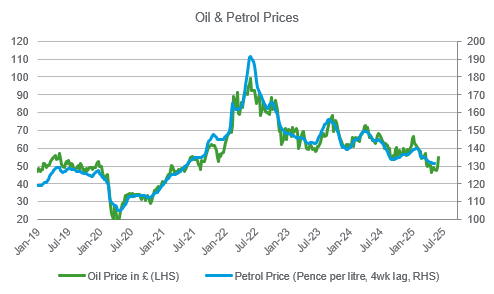

“There’s generally about a 4 week gap between movements in oil prices and petrol prices – the chart below illustrates this quite well,” Thomas Pugh, chief economist from RSM UK told The Independent.

Over the past month, Brent oil has risen from the mid-60s to its current price point – a rise of more than 18 per cent.

How oil prices affect inflation

As noted earlier, the spike seen in 2022 contributed enormously to rising energy bills. It’s not just that higher oil (and gas) means higher bills for those commodities when businesses or households eventually use them, but also that it in turn means higher transport costs and production costs.

All this is a contribution to rising inflation.

Mr Mould noted that “Israel’s first missile strike on Iran 10 days ago will already have had some inflationary impact,” which in UK terms will be seen as another blow to efforts to get the economy growing.

“If oil and natural gas prices stay where they are currently, that will add about 0.1 percentage point to inflation in Q3,” predicted Mr Pugh. “In terms of overall inflation impact, the rule of thumb is that a $10 per barrel rise in oil prices nudges up inflation by about 0.1ppt in the short term and closer to 0.2ppt in the long term, once the impact has filtered through the supply chain.”

With UK inflation at 3.4 per cent last month, the danger now is that these external factors mean domestic inflation faces another threat, which in turn might force interest rates to remain higher for even longer than expected – in turn again slowing economic growth efforts.