The taxman has no idea how much is being collected from billionaires amid mounting calls for a wealth tax, a powerful Commons committee has found.

With Rachel Reeves seeking billions of pounds to plug a gaping hole in the public finances, HM Revenue and Customs (HMRC) cannot identify how much tax is paid by Britain’s billionaires.

Despite there being relatively few billionaires, and the group contributing a significant amount to the government’s coffers, the Public Accounts Committee (PAC) said HMRC “does not know how many billionaires pay tax in the UK or how much they contribute overall”.

The authority “can and must” do more to understand how much tax the very wealthiest are paying, it added.

The stark warning comes as Labour MPs are piling pressure on the chancellor to introduce a wealth tax in her Budget this autumn, with Ms Reeves needing billions of pounds of tax hikes or spending cuts to meet her fiscal rules.

After the government’s chaotic U-turn on planned benefit cuts, squandering £5bn of annual savings, MPs have argued ministers should target the rich to make up the shortfall.

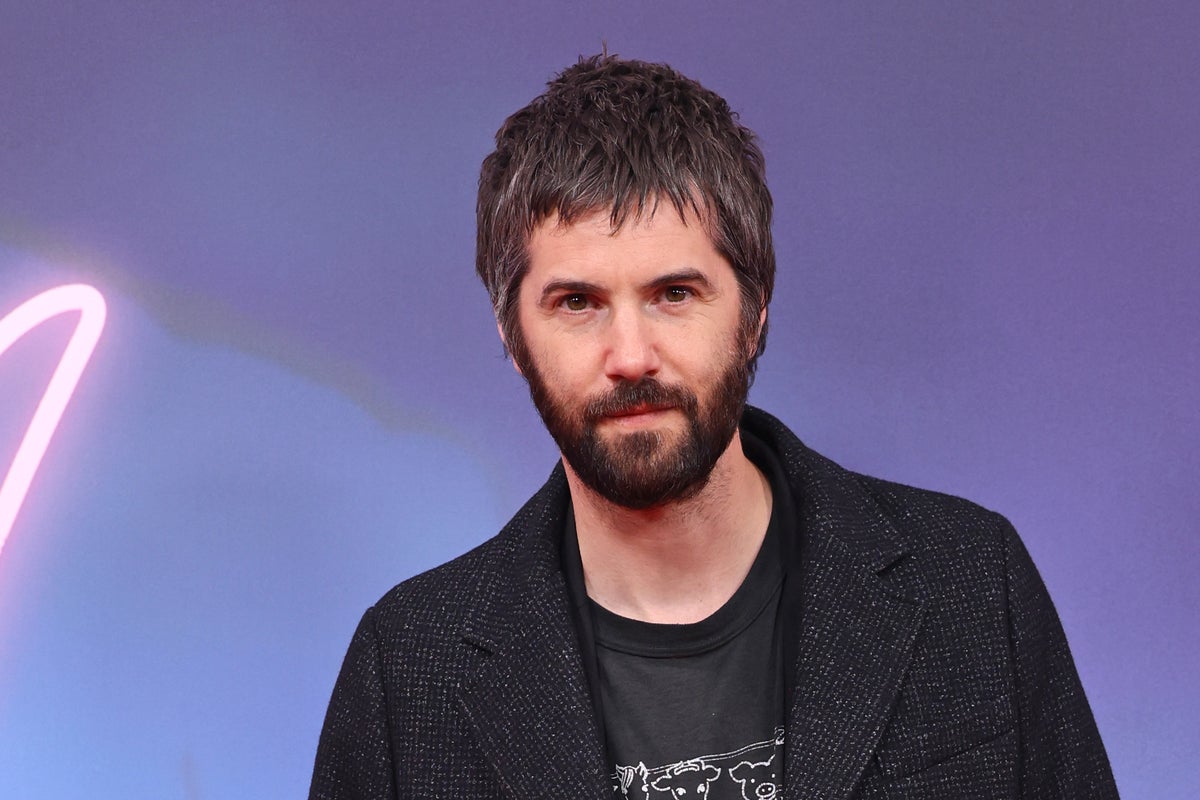

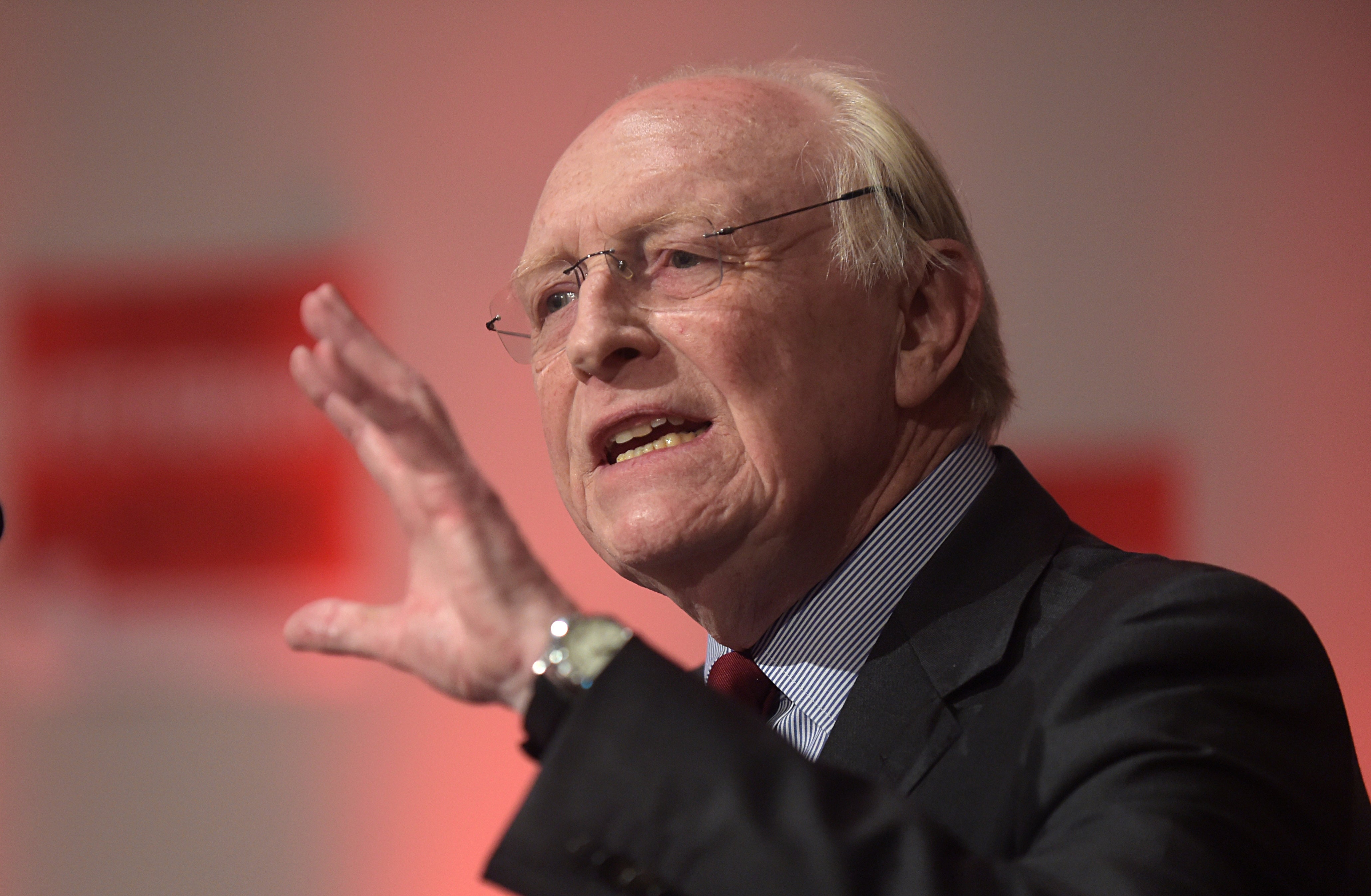

They were backed by former Labour leader Lord Kinnock, who has called for a 2 per cent tax on assets over £10 million, arguing it could raise up to £11bn a year and help shore up the UK’s finances.

Sir Keir has kept the option on the table, heightening fears of an exodus of the super-rich from Britain. Analysis by the consultancy New World Wealth showed a quarter of the UK’s billionaires, 18 in total, left the country in the last two years, more than any other country.

The PAC’s warning about HMRC sparked a backlash among MPs campaigning for a wealth tax, with Labour left-winger Kim Johnson condemning the ability of the super-rich to “operate in secrecy”.

She told The Independent: “This says everything about the priorities of this government – more focused on shielding extreme wealth than scrutinising it. Under Rachel Reeves’ arbitrary, self-imposed fiscal rules, we’re told there’s “no money” for public services, yet there’s no effort to even find out whether the wealthiest are paying what they owe.

“We need the political will to ensure that those with the broadest shoulders do carry more of the burden. But instead, we’re left with a system that lets billionaires hide in the shadows. This isn’t a technical failure – it’s a deliberate political choice.”

Ms Johnson added: “In what world is it acceptable for the super-rich to operate in secrecy, while the working-class are squeezed at every turn?”

Labour MP Nadia Whittome told The Independent Britain “needs a tax system that closes loopholes and guarantees that wealthy individuals pay their fair share”.

She added: “That must start with the government doing more to understand how much tax billionaires are currently paying and the opportunities for taxing the super-rich more.”

Campaign group Tax Justice UK said the PAC’s findings undermine public faith in the tax system. “At the heart of this story is the urgent need for HMRC to have the resources and political backing for it to be an effective and efficient tax authority that can administer a tax system that is fair and fit for the 21st century,” interim director Fariya Mohiuddin said.

The PAC highlighted The Sunday Times Rich List and artificial intelligence (AI) as ways that the revenue body could dig deeper into wealth and assets.

It is calling for HMRC to publish its plan for increasing tax yield from wealthy taxpayers both domestically and offshore.

It said HMRC does not collect information on taxpayers’ wealth and says that it only collects the data needed to administer the tax system as required by UK tax legislation.

The report said: “There is much public interest in the amount of tax the wealthy pay.

“People need to know everyone pays their fair share.”

HMRC’s plan for improving its understanding of the wealth and assets held by billionaires could include how it might immediately start work on comparing available data on known billionaires, such as The Sunday Times Rich List, with its own records, the report suggested.

In the United States, the Inland Revenue Service has worked with researchers to link its data to The Forbes 400, the report said.

There is “much more” that HMRC can do to improve its work to risk assess and target wealthy people, in particular through the use of data and technology and recruiting wealth management experts, it added.

PAC member Lloyd Hatton said: “This report is not concerned with political debate around the redistribution of wealth.

“Our committee’s role is to help HMRC do its job properly ensuring wealthy people pay the correct tax.

“While HMRC does deserve some great credit for securing billions more in the tax take from the wealthiest in recent years, there is still a very long way to go before we can reach a true accounting of what is owed.

“We already know a great deal about billionaires living in the UK, with much information about their tax affairs and wealth in the public domain.

“So we were disappointed to find that HMRC, of all organisations, was unable to provide any insight into their tax affairs from its own data – particularly given that any single one of these individuals’ contributions could make a significant difference to the overall picture.

“We found a similar apparent lack of curiosity in how wide the tax gap is both for the very wealthy and for wealth stashed away offshore.”