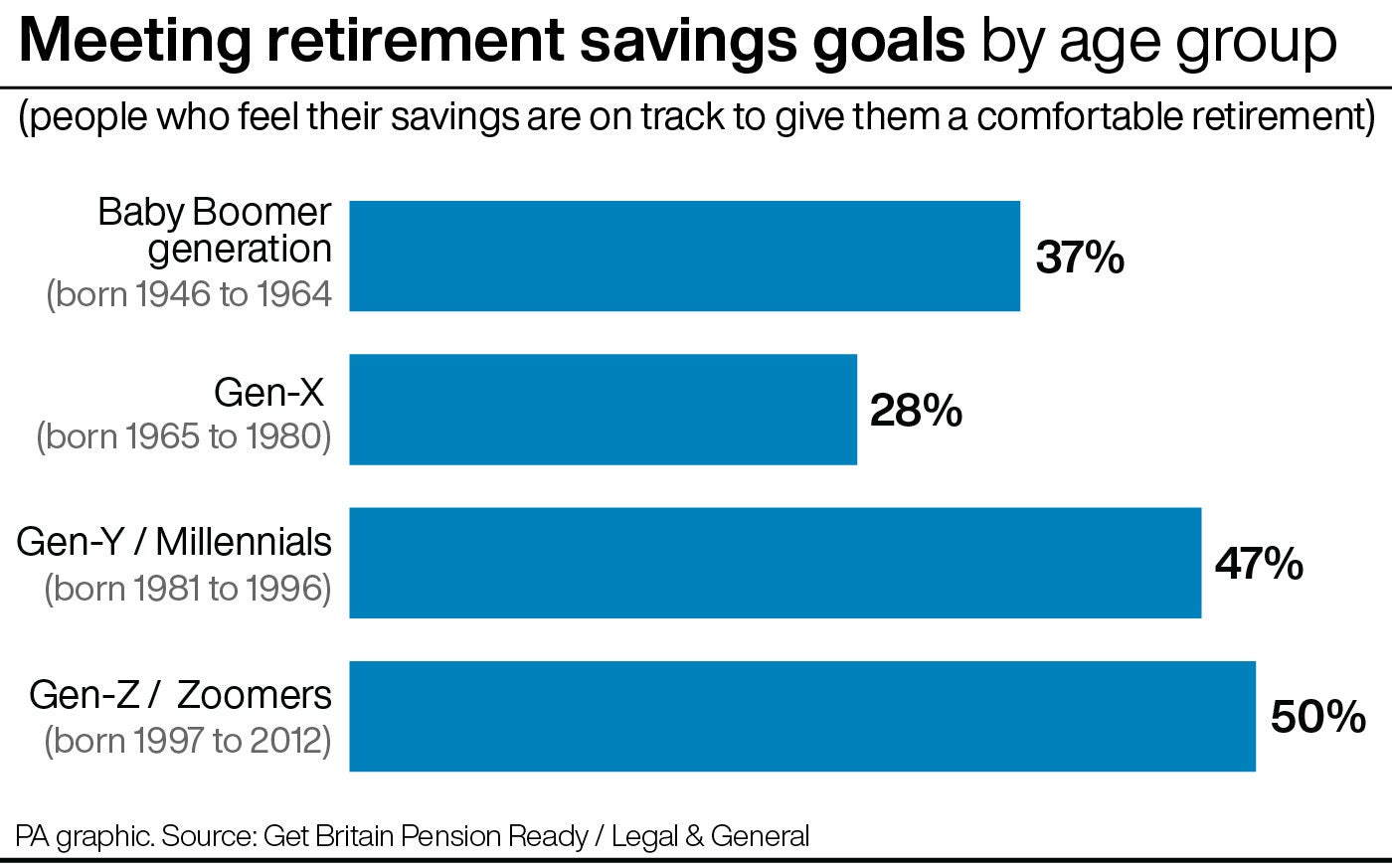

Generation X, those born between 1965 and 1980, are the least likely to feel confident about their retirement savings, according to a recent survey. Less than three in 10 (28%) believe they are on track for a comfortable retirement, a significantly lower proportion than younger generations like Gen Z (50%) and Millennials (47%), and even trailing behind the older Baby Boomer generation (37%).

Commissioned by the Get Britain Pension Ready campaign for Annuity Ready, a lifetime annuity comparison service within the Legal & General Group, the research suggests that Generation X faces a more complex retirement planning landscape than their generational counterparts. This raises concerns about the financial security of those approaching retirement age and highlights the need for greater support and resources to help them prepare for the future.

While some people in older generations may have had salary-based pensions to rely on in their later years, 65% of Gen-X said a final salary pension scheme is no longer available to them as a savings option, despite nearly half (45%) indicating that it was when they first started working.

And while many people in younger generations will be automatically placed in a workplace pension early on in their careers, 30% of the Gen-X age group surveyed said the auto-enrolment workplace pension initiative was not introduced in time to make a significant difference in their overall pension savings.

Nearly one in six (17%) members of Generation X said they are worried about never being able to fully retire, according to the OnePoll survey of 2,000 people across the UK in December.In addition to savings shortfalls, two-thirds (66%) of Gen-Xers cited living costs and 59% cited the state pension as reasons for doubting their ability to retire.

Sarah Lloyd, spokesperson for Get Britain Pension Ready, said: “Brits across the board are feeling the pressure, with an alarming number of people worried they might never be able to retire.”

People can take steps to see if they are on track for retirement by checking their state pension forecast on gov.uk, tracking down any lost pensions using the Pension Tracing Service and considering increasing their workplace pension contributions, if they can.