The Dow Jones Industrial Average crossed a historic threshold on Friday, passing the 50,000 point mark for the first time in its history.

The record-setting moment suggests that investors in the 30 companies tracked by the index, and other major corporations, have confidence that they will fare well in the current economy.

It comes after weeks of steady gains on the index, driven in large part by AI and other tech investments. American semiconductor manufacturer Micron’s stock price has increased approximately 18 percent year to date, and that is after it enjoyed a 240 percent price increase over the entirety of 2025.

“Tech kind of took a pause at the back end of the year, but I don’t think anyone questions that AI is a game-changing technology,” Ross Mayfield, an investment strategist at Baird, told CNBC. “We’re seeing the chip stocks lead. That’s probably to be expected, but that cyclical rotation is still continuing.”

Recent global developments — such as the uncertainty caused by President Donald Trump’s tariff regime introduced in April last year and the administration’s often aggressive foreign policy – hasn’t shaken investors.

“It’s early in the year, but so far markets don’t appear too concerned about the developments in South America,” Brent Cantwell, U.S. investment analyst at online brokerage eToro., told USA TODAY.

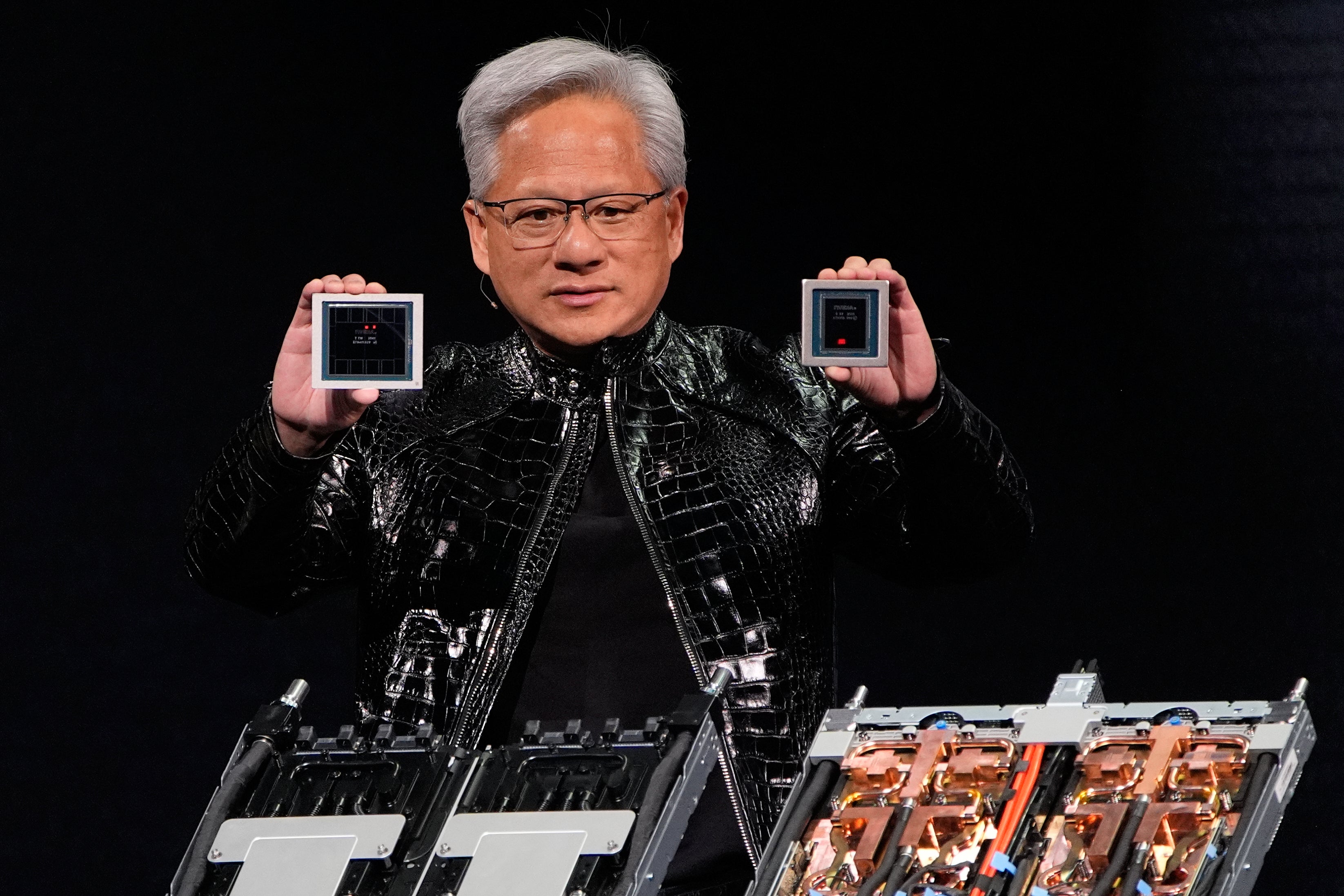

Tech companies, specifically those involved in storage and semiconductor manufacturing, marked significant gains early in January, driven, in part, by renewed confidence after Nvidia CEO Jensen Huang’s presentation about forthcoming AI processors at the Consumer Electronics Show in Las Vegas on January 5.

The march toward 50,000 picked up at the end of 2025, when financial analysts began backing Amazon and its cloud technologies as a major untapped investment opportunity. That confidence helped push Amazon’s stock price up by more than 2.9 percent, marking a significant contribution to the Dow’s gains.

Amazon’s inclusion in the Dow in 2024 — replacing Walgreens Boots Alliance — helped ignite the Dow’s steady gains in the last two years, according to MarketMinute.

Amazon’s performance, paired with AI enthusiasm and confidence in energy and financial sectors, then carried the index past 50,000. Predictions from financial analysts that the interest rate will likely be cut to 3 percent in 2026 also helped to motivate investors.

The Dow hit the 50,000 mark in about half the time it took to cross the 40,000 mark. According to market data, it took the Dow approximately three and a half years — from November 2020 until May 2024 — to go from 30,000 to 40,000, but only an additional year-and-a-half to hit 50,000.

Before that, it took the index roughly four years to go from 20,000 in 2017 to 30,000 in 2020.

While the milestone is certainly exciting for those with significant investments in major companies, the gains won’t necessarily mean much for regular Americans. Indirect benefits for those who don’t own shares can include job opportunities and pension security.

Affordability is still a serious issue for many Americans, made worse by stubborn inflation, Trump’s trade wars and skyrocketing health insurance costs due to the expiration of pandemic-era insurance subsidies.

More follows …