UK inflation has fallen in some areas driven by decreased air fares and motor fuel dropping in price – though some food prices increased and so too did household goods.

The Office for National Statistics said that its key measure of inflation, the consumer prices index, was 3.4 per cent in May – having also been 3.4 per cent after revised figures in April, its highest level for more than a year.

Inflation in the UK had been dropping, having reached a high of 11.1 per cent in October 2022. A rise for April was expected due to raised labour costs, rising energy bills and changes to social housing costs, among other factors.

But the leap was above the expected figure and led Chancellor Rachel Reeves to acknowledge disappointment at the rise.

A drop in some areas for May will be taken as a limited positive, though inflation remains some distance above the Bank of England’s government-mandated 2 per cent target.

Acting Chief Economist Richard Heys said: “A variety of counteracting price movements meant inflation was little changed in May.

“Air fares fell this month, compared with a large rise at the same time last year, as the timing of Easter and school holidays affected pricing. Meanwhile, motor fuel costs also saw a drop.

“These were partially offset by rising food prices, particularly items such as chocolates and meat products. The cost of furniture and household goods, including fridge freezers and vacuum cleaners, also increased.”

CPI vs CPIH

The headline figure of 3.3 per cent inflation refers to Consumer Prices Index (CPI), the commonly used measure of tracking inflation.

However, the ONS also hands out another inflation rate called CPIH: Consumer Prices Index including owner occupiers’ housing costs. This is the data set which includes CPI factors but also adds in the costs associated with owning and maintaining a home, including council tax.

ONS say this is the most comprehensive measure of inflation, to more accurately reflect the changing cost of living for households.

As such, CPIH also came down in May to 4.0 per cent, from 4.1 in April (later revised to 4.0 through new VED figures).

Thomas Pugh, chief economist and tax and audit firm RSM noted the decrease was in part due to “some unwinding of the huge increase in airfares – which saw the biggest monthly rise since 2011 – and package holidays, as these were almost certainly due to the timing of Easter”. However, Mr Pugh also noted that “some of that [was likely] offset by a rebound in clothes prices, which fell by the most on record in April.”

Oil and interest rates

Future inflation rates across 2025 are largely expected to head downward, as the BoE continues to keep a tight leash on higher interest rates.

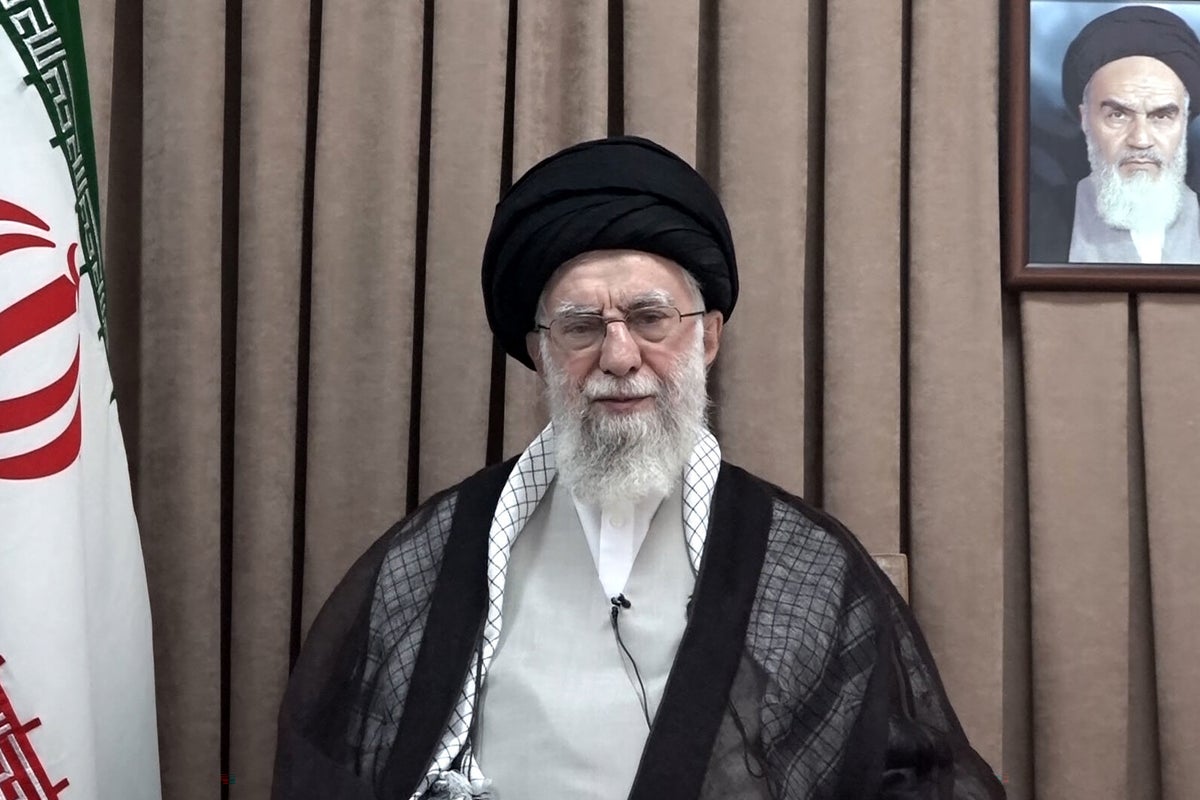

However, that direction may now be in question as the situation develops with Israel and Iran. Missiles sent into Tehran gave fears of rising escalations, with Iran – which exports more than 1.5m barrels a day – controlling a key shipping route which they could close off in the event of any full conflict.

That would in turn, see oil prices rise enormously. The price of Brent Crude Oil has already risen 12 per cent in the past week and briefly surged above $77 before falling back, having spent much of the past two months in the low 60s.

The second factor impacted by this inflation data is interest rates, with the BoE’s MPC due to meet on Thursday for their latest decision.

While unemployment has risen and wage growth has slowed, last month’s inflation rise plus these latest geopolitical developments mean the MPC is widely expected to hold the base rate at 4.25 per cent, ahead of further potential cuts later in 2025.