The Federation of Small Businesses (FSB) has said that removing barriers to self-employed individuals accessing mortgages and retirement savings could significantly boost entrepreneurship and stimulate UK economic growth.

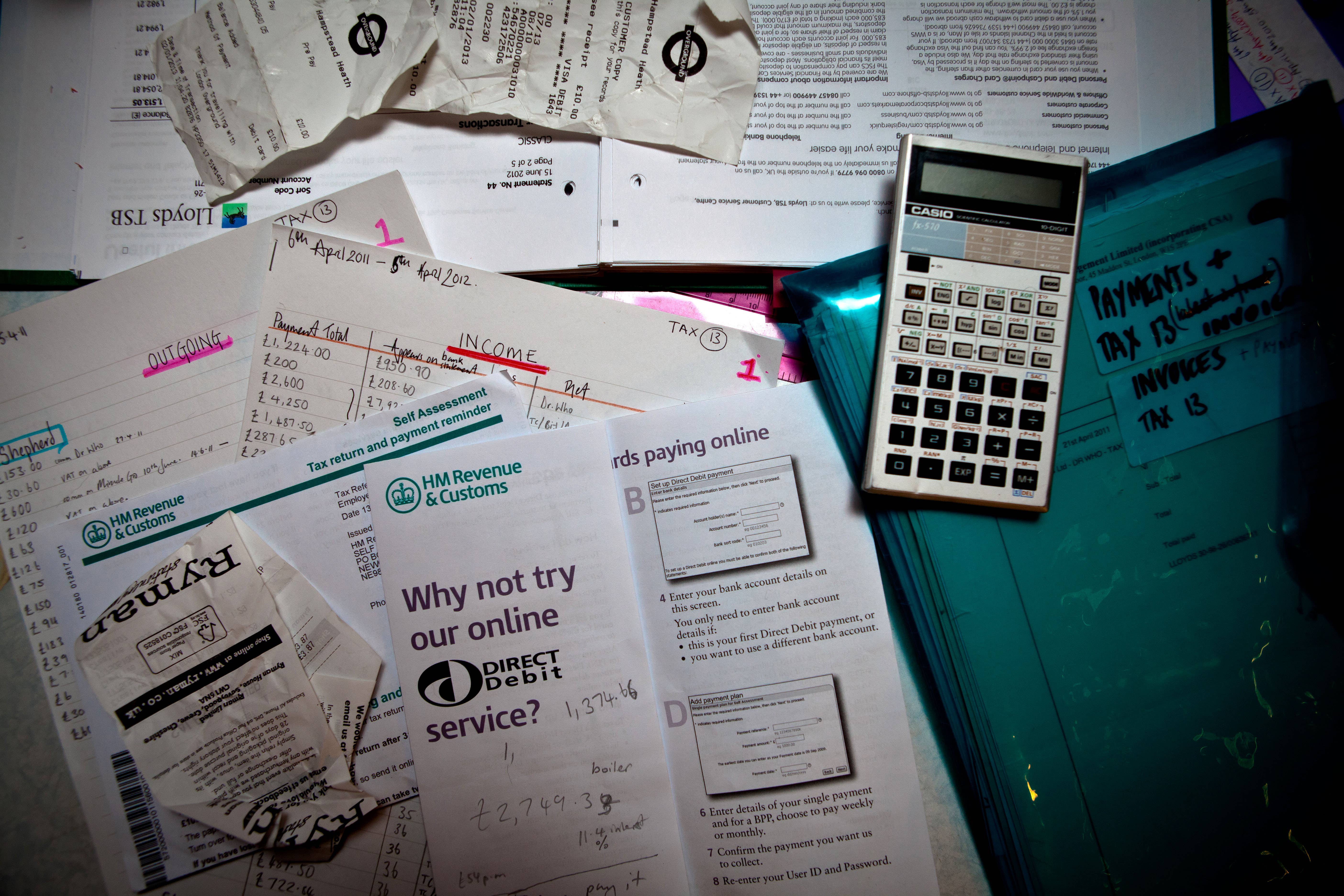

A recent FSB-commissioned survey highlights the financial hurdles faced by the self-employed, impacting both their personal and business prospects.

The survey, conducted by Verve across the UK in October and November 2023, polled over 1,300 self-employed individuals. A quarter of respondents reported difficulties securing a mortgage due to their self-employed status. A total of 16% revealed they are diverting funds, which could otherwise fuel business expansion, towards mortgage repayments.

The findings also shed light on the financial juggling act many entrepreneurs perform. To maintain or grow their businesses, many rely on bank overdrafts (17%), credit cards (16%), and even financial assistance from family and friends (9%). The FSB also raises concerns about the excessive use of personal guarantees for business loans, arguing that this practice stifles growth by discouraging risk-taking among entrepreneurs.

Retirement planning also appears to be a significant challenge for the self-employed. Over a third (37%) of those surveyed admitted to not contributing to a pension, primarily due to cash flow constraints, a factor cited by 32% of those who hadn’t made pension contributions in the past year. These findings underscore the need for policy changes to support self-employed individuals in building a secure financial future, both for themselves and their businesses, ultimately contributing to a stronger UK economy.

People who are employees rather than self-employed are often automatically placed into a workplace pension by their employer, where they benefit from pension contributions from the firm they work for as well as their own contributions and tax relief.

The FSB is calling for the mortgage application process to be simplified for self-employed people, with a standardised approach across lenders so that people can be better-prepared in understanding what information they will need to provide.

Lenders could also be encouraged to consider offering lower mortgage rates to self-employed people who have taken out income protection insurance, the FSB said.

It also claimed that lenders can overuse requests for personal guarantees, which can have a chilling effect on the economy, causing limited company directors to put personal assets such as their homes on the line when taking on a loan.

Such guarantees should be under the scope of the Financial Conduct Authority (FCA)’s Consumer Duty, to deter overuse, the FSB said.

The duty requires financial firms to put the customer at the heart of what they do.

Tina McKenzie, FSB’s policy chairwoman, said: “By solving the finance conundrum too many entrepreneurs find themselves in, we can help to unlock the growth we need to get the economy on track.”

She said: “People who decide to take a leap into the unknown by embracing entrepreneurship are taking on many risks – not least that of no longer being able to rely on a secure income.

“Income volatility adds additional barriers to accessing finance products, such as mortgages and external finance for their business, and makes saving for a pension harder.

“The impact of this should be minimised to encourage more people to take the leap without worrying that they will be locked out of common financial milestones as a result.

“The dream of owning your own home is firmly entrenched in our national culture, while we all aspire to a comfortable retirement, but these things should not be a privilege reserved for those in conventional employment.

“Keeping Business Asset Disposal Relief at 14% could help entrepreneurs avoid erosion of their retirement funds.

“As the Government develops its Small Business Strategy for publication later this year, it must cater to the needs of the self-employed.

“Getting this right will enable entrepreneurs to do what they do best – innovate, adapt and create.”

David Raw, managing director of commercial finance at UK Finance said: “The banking and finance industry supports millions of SMEs and entrepreneurs across the country. They are a vital part of the economy and we want them to succeed.

“Personal guarantees play an important role in enabling lending to take place. They can unlock finance that would not otherwise be available and also lead to businesses accessing cheaper rates.

“We recently issued a series of industry commitments on how personal guarantees are used to support lending. The vast majority of personal guarantees are not called upon and there is a competitive market with a range of options for borrowers who do not want to sign one.

“There are a number of mortgage options available for the self-employed from a range of lenders. An independent mortgage broker will be able to give advice on different lenders’ approaches and what documentation they will require.

“A number of banks also have helpful guides on their websites to support the self-employed when considering applying for a mortgage.”

An FCA spokesperson said: “We will read the report with interest and consider the recommendations.”

The regulator recently said it will be looking in general at rules around mortgages. Some commercial lending is outside the scope of the FCA’s regulation and its remit is established by legislation.

A Government spokesperson said: “We are going further and faster to drive growth through our Plan for Change, to put more money into working people’s pockets.

“That means making Britain the best place to start and scale up a business, which is why we’re tackling the scourge of late payments and introducing a fairer business rates system which incentivises investment.

“The UK benefits from a competitive mortgage market and any prospective mortgage borrower should shop around to find the best possible mortgage product for their circumstances.”