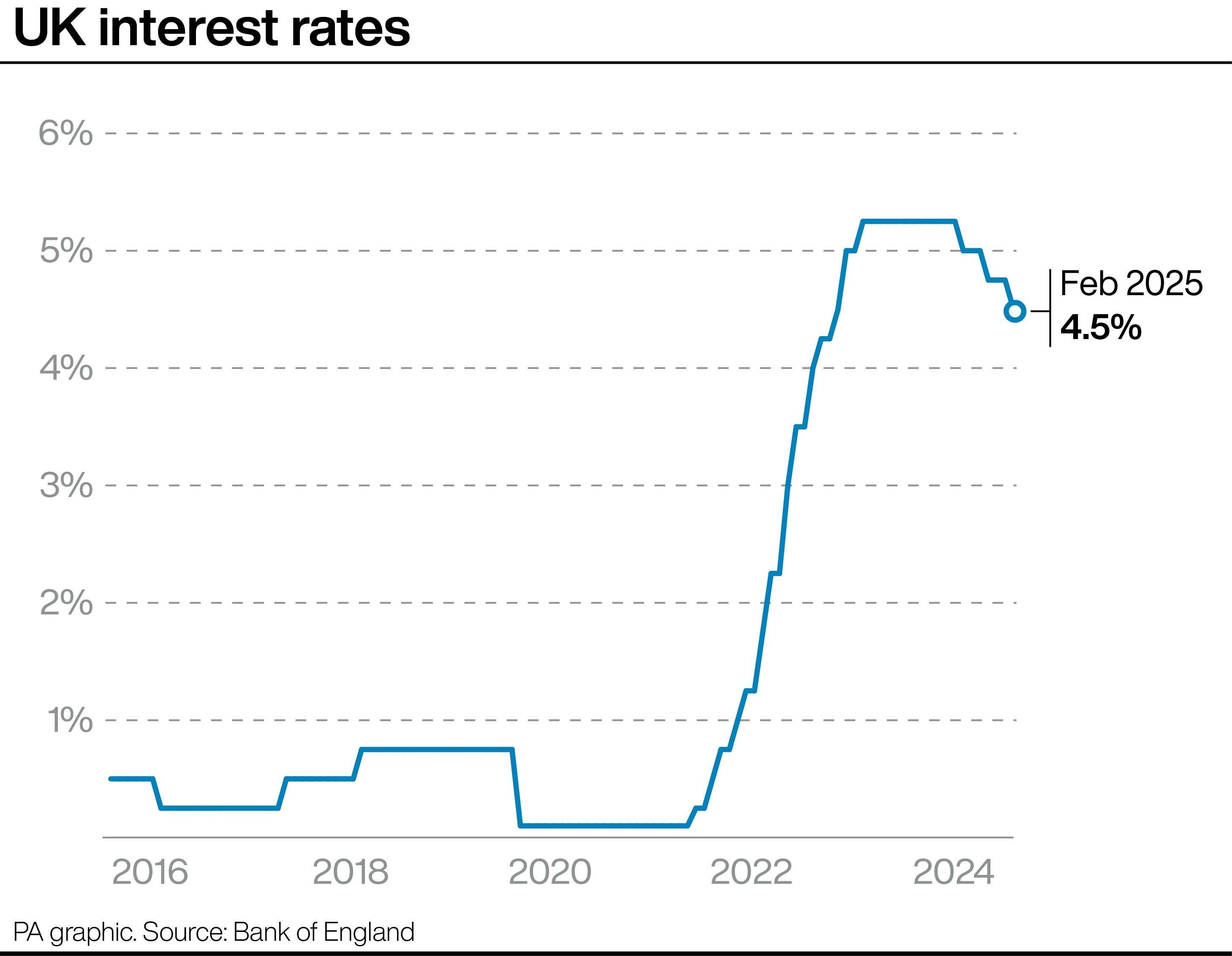

Rachel Reeves has received a much needed boost in her push for economic growth after the Bank of England announced a cut in interest rates but was dealt an immediate blow over projections that inflation is set to rise.

As well as providing relief for many businesses, the cut will help thousands of people on mortgages who will see there monthly payments fall. A homeowner with a £300,000 tracker mortgage will see monthly repayments fall around £43 from £1,710 to £1,667.

However, in a blow to the chancellor growth expectations have been downgraded because of the extra NHS spending in Ms Reeves’ Budget last year and inflation is now expected to rise to 3.7 per cent, higher than previously estimated.

But it is the first piece of good news for a chancellor who has been beset by poor economic figures since taking office seven months ago and has also been the subject of speculation about whether she can survive in the Treasury.

The announcement follows Ms Reeves’ major speech last week where she doubled down on her economic growth agenda in a bid to relaunch her economic plan with proposals to unleash massive building projects across the UK including a new runway at Heathrow Airport.

Downing Street also backed the chancellor, repeating a pledge she will stay in the role for the whole of this Parliament.

But shadow chancellor Mel Stride said that while the cut in interest rates “will be welcome news for families and businesses who have been hit hard by Labour’s appalling mismanagement.. the Bank of England say growth is weaker than expected, confidence is falling and Labour’s Budget is fuelling inflation”.

The bank’s governor Andrew Bailey said: “It will be welcome news to many that we have been able to cut interest rates again today.

“We’ll be monitoring the UK economy and global developments very closely, and taking a gradual and careful approach to reducing rates further.

“Low and stable inflation is the foundation of a healthy economy and it’s the Bank of England’s job to ensure that.”

The Bank’s rate setting Monetary Policy Committee (MPC) voted by 7 to 2 to bring rates down. Two members of the MPC voted for a bigger 0.5 percent cut.

However, in less good news for Ms Reeves, the Bank downgraded its forecasts for growth projecting that GDP fell 0.1 per cent in the fourth quarter of 2024 and will rise by just 0.1 per cent in the first quarter of 2025.

The interest rate cut has been welcomed across the political spectrum as well as by businesses and trade unions.

TUC general secretary Paul Nowak said: “This rate cut is badly needed to help lift the economy out of stagnation. The Bank must now keep moving with further cuts to support households and businesses in the months ahead.

“Lower borrowing costs will ease pressures on households, helping families with their weekly budgets and leaving them with more to spend. And it will make it more affordable for businesses to invest and grow.”

Alpesh Paleja, deputy chief economist, CBI, said: “Today’s cut to interest rates was in line with our expectations and reinforces our view of a gradual loosening in monetary policy over this year.”

But he warned: “However, the Monetary Policy Committee are increasingly having to balance conflicting objectives. The CBI’s surveys show that business’ growth and hiring expectations have weakened. But inflation expectations are picking up, exacerbated by the rise in employment costs arising from October’s Budget.

“Therefore, while we still expect a few more rate cuts this year, risks to this forecast are now balanced in either direction. Incoming data over the coming months will be key in determining how the MPC will move next.”

In response to the Bank’s announcements, Downing Street said investing in the NHS was “good for the economy and good for growth”.

On the projected inflation rise, No 10 pointed to the latest forecast by the Office for Budget Responsibility (OBR) that it would remain close to the target of 2 per cent.