- New £2.3million Regulatory Partnership for Growth Fund will help to unlock export opportunities worth nearly £5 billion for UK companies over five years

- Sectors like clean energy and life sciences set to benefit, as fund targets trade barriers worth £300m in its first year

- Announcement comes as Jonathan Reynolds visits Brazil for G20 trade talks

The UK’s pharmaceutical industry will find it easier to sell innovative medicines in huge markets like Brazil and around the world thanks to a new fund to cut red tape and boost exports.

Trade Secretary Jonathan Reynolds will announce the new £2.3 million Regulatory Partnership for Growth Fund as part of a three-day visit to Brazil, which will include his first G20 meeting.

The fund builds on the Prime Minister’s call at the International Investment Summit last week for UK regulators to support the Government’s growth mission, keep pace with emerging industries and upgrade the regulatory regime to make it fit for the modern age.

The fund will help UK regulators work with international partners to remove trade barriers and shape markets in various growing sectors. This will see sectors benefit from a potential £5 billion of new export opportunities over five years, with trade barriers worth £300 million being targeted within the first 12 months – which would be equal to an average of £135 in exports per pound invested.

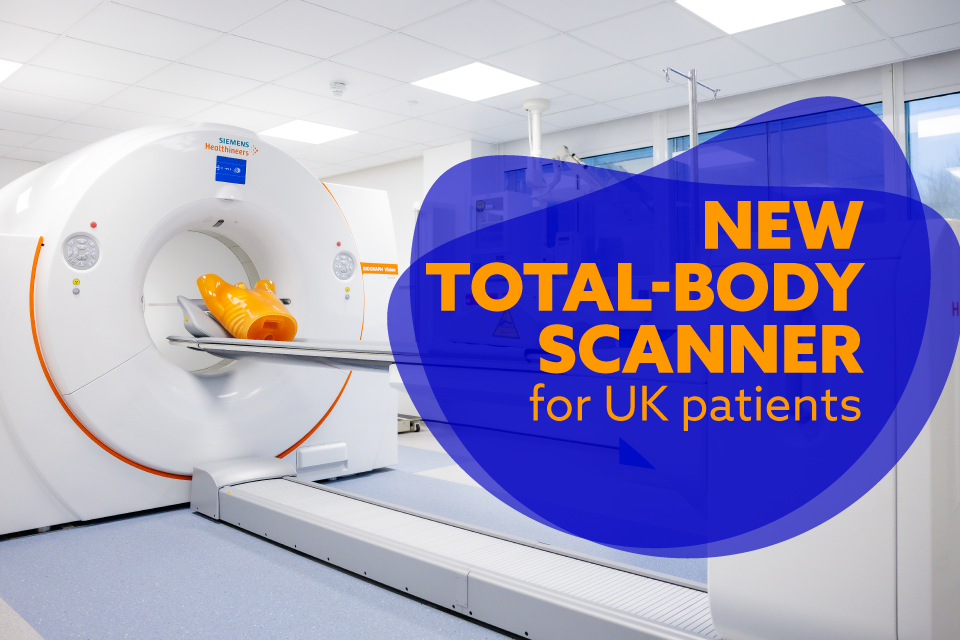

In an exciting project in the life sciences sector, this will see UK regulators and expert bodies work closely with Brazil’s Ministry of Health in sharing best practice around evaluating cancer drugs, supporting them to improve their nation’s health while making it easier for the industry to access Brazil’s pharmaceutical market.

Business and Trade Secretary Jonathan Reynolds said

We are rolling up our sleeves and removing red tape where it is holding this country back from harnessing every opportunity available.

This multi-million-pound fund will unleash the potential of some of the most prominent sectors in the UK, and through our excellent regulators businesses will find it easier to sell their world class goods and services to Brazil and other partners around the world, as we continue to build momentum ahead of our new Industrial Strategy.

The fund will also

- enable the Offshore Renewable Energy (ORE) Catapult to partner with Brazil as it develops a comprehensive offshore wind regulatory framework, which could generate an additional £55 million of exports over five years for the UK supply chain.

- in the professional services sector, the Law Society will build closer relationships with other countries to reduce requirements for UK lawyers to practice overseas, including in some US states, where they have faced onerous requirements.

- support UK regulators who will aim to improve the process for accreditation of UK education programmes, such as university degrees, in countries all over the world, including Malaysia.

Dr Stephen Wyatt, Director – Strategy and Emerging Technology, ORE Catapult said

The UK is a world leader in offshore wind and, in partnership with the Department for Business & Trade, we now have the opportunity to translate two decades of experience into new export opportunities for UK companies.

Our work will help other countries to accelerate their plans to develop offshore wind and pinpoint key areas, such as floating wind, project development, and operations and maintenance where the UK’s leading companies can also flourish overseas.

Richard Atkinson, President of The Law Society England and Wales said

The Law Society of England and Wales appreciates the government’s initiative to establish the Regulatory Partnership for Growth Fund.

This funding will provide essential support to UK businesses by helping them move past regulatory barriers in various global markets.

By building closer relationships with countries overseas, this fund will contribute to the growth and progression of the legal profession globally.

It comes as the Trade Secretary heads to São Paulo and Brasília to build on the UK’s strong and enduring relationship with Brazil, meeting investors including one of the world’s biggest aircraft manufacturers, Embraer, as well as some of the largest UK businesses in Brazil such as Astra Zeneca.

The Trade Secretary will then meet Brazil’s Vice President and Trade Minister Geraldo Alckmin in Brasília, where they will talk about how to build on the over £10bn of UK-Brazil trade last year and implementation of Brazil’s Industrial Strategy ahead of the UK publishing its own next year. He will then meet his G20 counterparts and call for pragmatic and meaningful reform to strengthen the World Trade Organization, as well as action to promote gender equality in trade.

The Trade Secretary will also use the visit to hold the first bilateral meeting on trade between the UK and Argentina since 2019 when he meets with his counterpart Diana Mondino, where he will commit to strengthening the UK’s trade and investment relationship in line with both governments’ goals to support economic growth.

He will also speak to the Vice-President of the European Commission Valdis Dombrovskis, where he will emphasise the importance on resetting the relationship between the UK and the EU.

The meetings are alongside wider G20 discussions under Brazil’s presidency on sustainable investment and how trade can drive greener and more sustainable development, ahead of South Africa taking on the G20 Presidency in 2025.

Notes to Editors

- Not all the trade barriers that are part of the £2.3m fund can be made public due to commercial or diplomatic sensitivity.

- The data on trade barriers to be resolved by the £2.3m fund is extracted from the Digital Market Access Service (DMAS). DMAS is not a comprehensive repository of all market access issues facing UK exporters, and reporting rates vary widely across countries and regions

- The £2.3m fund will be used to aid the resolution of 36 barriers in scope – the aggregate valuation of these barriers is around £5bn over 5 years. The aggregate figure of around £300m over 5 years is for a sample of 6 barriers only. To calculate the aggregate figures, the mid-point for each valuation range is estimated over a five-year period and added to provide a central estimate. Further details on the methodology for the aggregate valuation figures are published in a DBT analytical working paper. In some cases, estimates may have been sourced externally from industry.

- The figure of around £135 in export value per pound over five years is calculated by dividing £300m by the cost of the fund (£2.3m). This is a potential export win and it should not be interpreted that every additional pound might get another £135 in return.